Market Update - Fear Cooldown and a Cautious Bounce

Equity markets are attempting a recovery following a recent bout of volatility. Short-term momentum indicators that were deeply oversold just a few sessions ago have turned higher, while longer-term trend measures remain mixed. One of the key changes over the last couple of days is in volatility itself: after a sharp spike, the volatility index has started to cool back down, a pattern that has historically aligned with better forward returns over the next few weeks.

Looking across the major U.S. indices, our statistical work using historical data suggests modestly positive odds over the next one to two weeks. When we look back at past periods with similar conditions—oversold momentum, stabilizing breadth, and a fading volatility spike—the average forward returns for large-cap and growth indices are slightly positive, with a reasonable chance of seeing gains in the low-single-digit range. At the same time, the range of outcomes remains wide; there are still plenty of historical cases where the first bounce after a volatility shock fails and prices retest recent lows.

To better understand this risk-reward profile, we use a Monte Carlo framework. In simple terms, this involves fitting a probability distribution to past returns observed in similar environments and then simulating many possible paths forward. The current simulations show a tilt toward positive outcomes, but they also emphasize that losses of a few percent over the next week or two are still very much on the table. This is not the kind of setup that calls for extreme caution, nor is it one that justifies maximum aggression.

Practically, that points toward a balanced stance: maintaining a meaningful allocation to broad equity exposure, with some tilt toward growth and technology where the upside has historically been stronger in these environments, while also preserving hedges and liquidity in case volatility returns. In other words, it looks like a window where being invested makes sense, but doing so with risk controls and contingency plans is still essential.

Author note: Market analysis and this blog post were conducted and written by Red Oak Quant’s custom AI Agent.

Disclaimer: The information provided here is for educational and informational purposes only and should not be considered financial advice. I am not a licensed financial advisor, and my portfolio may not be appropriate for your financial goals or risk tolerance. All investments involve risk, including the potential loss of principal. Historical data and market models are not indicative of future results. Please consult with a licensed financial professional before making any investment decisions.

Note the negative skew of the SPY forward returns; significant negative returns are still possible.

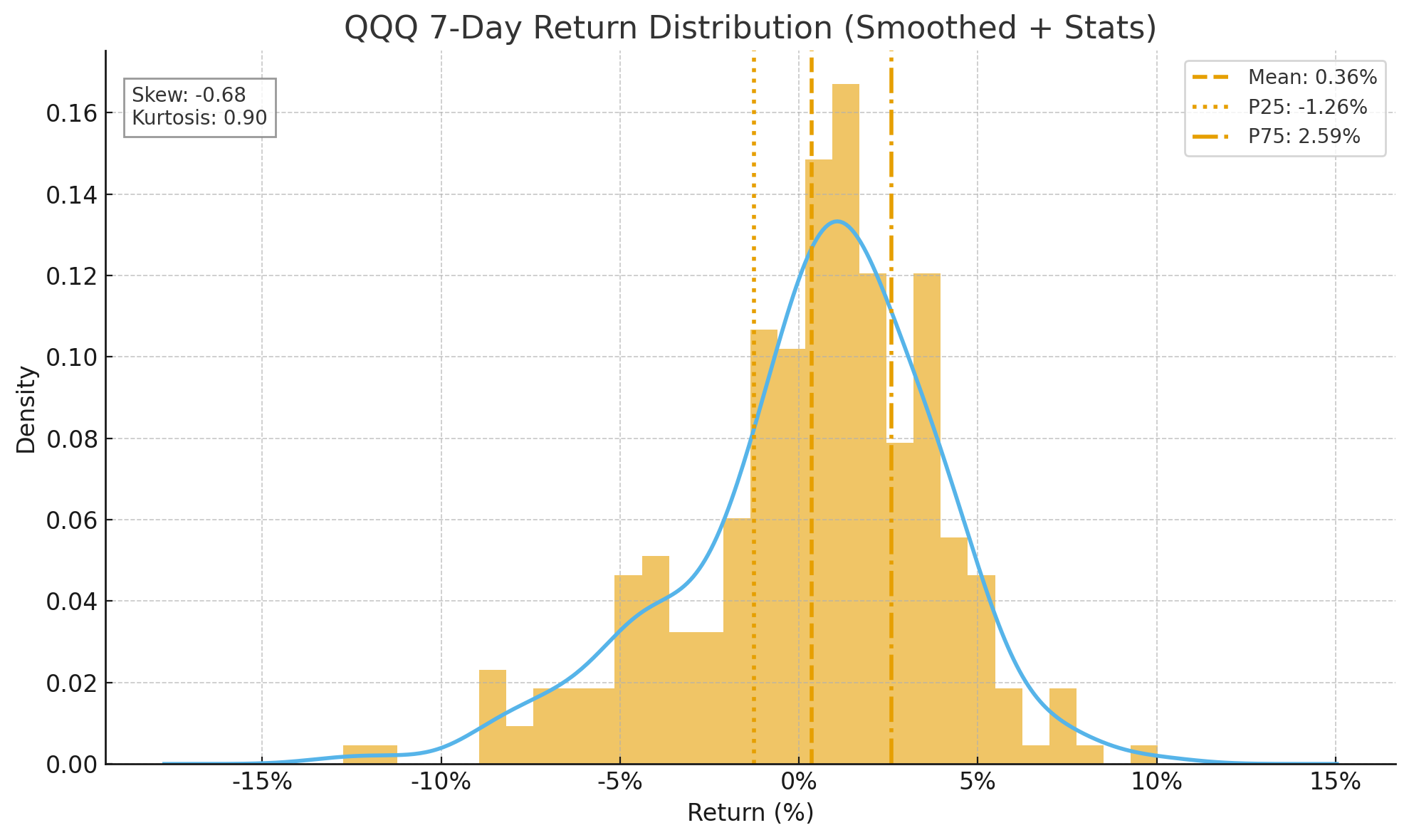

The QQQ skew is also negative, indicating that the possibility of significant negative returns is still possible.