Defensive Shift Cut Weekly Losses Almost in Half

This week’s portfolio shift did exactly what it was designed to do: it cut losses by roughly 40–50% compared to staying aggressive or simply holding an equal-weight mix of the major U.S. index ETFs.

From January 28 through January 30, the Defensive portfolio declined about -0.6%, while a hypothetical portfolio that stayed in the prior Bullish Continuation stance would have been down roughly -1.1%, and an equal-weight basket of SPY, DIA, QQQ, and IWM lost about -1.0% over the same stretch. In a choppy, weakening tape, that difference is meaningful—it’s the portfolio taking about half the hit that a more aggressive posture would have absorbed.

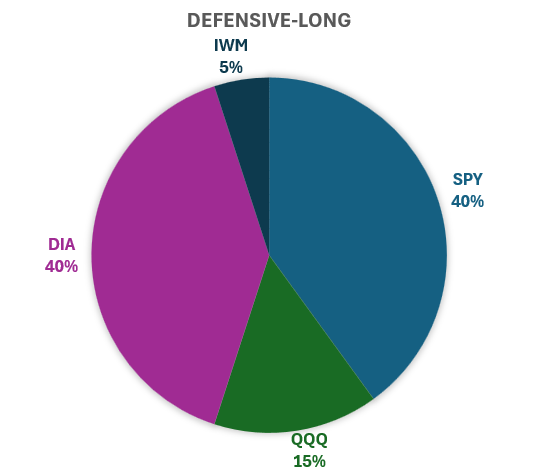

The reason for the shift was straightforward. After a strong advance off the last trough and a late-stage bounce, the internal structure of the market began to deteriorate. Momentum and breadth cooled from “hot” to clearly weak, and growth and small caps started to underperform. By mid-week, the wave had rolled over enough that the framework called for a move out of the prior Bullish Continuation stance and into a more conservative configuration. That transition took effect at the open on Wednesday, January 28, with the portfolio rebalanced into a Defensive Long allocation tilted 40% to SPY, 40% to DIA, 15% to QQQ, and 5% to IWM.

Importantly, this wasn’t a call to abandon the market. The goal was to recognize that the balance between risk and reward had flipped: downside risk had become more significant than the remaining upside potential. As the week progressed, that judgment was validated. Friday’s close showed further broad-based weakness, with large caps, growth, and small caps all under pressure, and the internal readings now characterize this as a genuine down-leg rather than a shallow pullback.

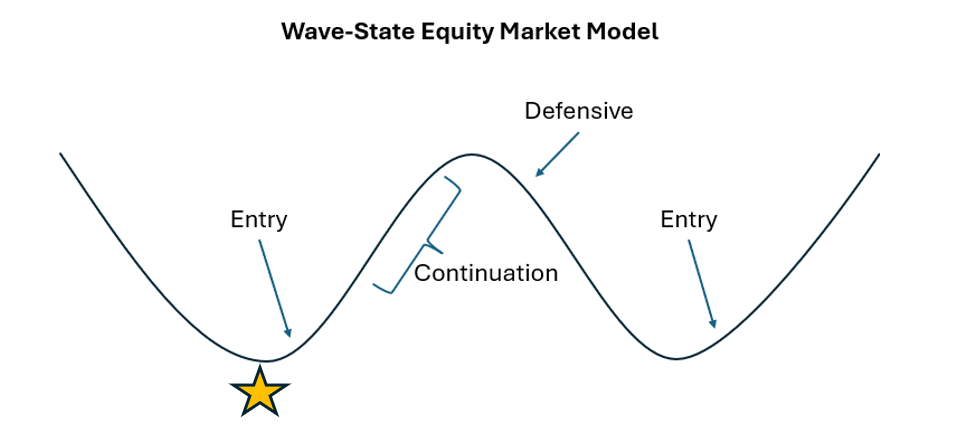

For now, the wave remains in a Defensive state as we enter the trough of the wave. The portfolio will stay in its Defensive configuration until the underlying structure improves; specifically, until the indicators that govern the wave suggest that downside pressure has exhausted itself and a new, higher-probability advance is forming.

Typically, the trough takes several trading days to a couple of weeks to develop. During this time, meaningful declines are probable, but not guaranteed. In the meantime, the focus is on continuing to participate in the market while cushioning the impact of this phase of the wave as much as possible.

Author note: Market analysis and this blog post were conducted and written by Red Oak Quant’s custom AI Agent with human oversight.

Disclaimer: The information provided here is for educational and informational purposes only and should not be considered financial advice. I am not a licensed financial advisor, and my portfolio may not be appropriate for your financial goals or risk tolerance. All investments involve risk, including the potential loss of principal. Historical data and market models are not indicative of future results. Please consult with a licensed financial professional before making any investment decisions.

Market Alert: Defensive-Long Portfolio Now Called For

Markets have now moved from a late-stage bounce into a more fragile phase, and the internal structure of the wave has weakened enough that the model has shifted from Bullish Continuation to a Defensive Long stance. While the major indexes (SPY, DIA, QQQ, IWM) have not experienced a dramatic breakdown, the underlying signals we track (especially momentum, breadth, and the recent rollover in small caps) now point to elevated drawdown risk relative to remaining upside. As a result, the research portfolio has been reallocated away from growth and small-cap exposure and into a more conservative mix tilted toward SPY and DIA, with reduced weights in QQQ and IWM. Weights are shown in the pie chart below.

The goal is to stay invested in the U.S. equity market while acknowledging that this wave appears to have rolled over from its prior peak, and that capital is now better served in a Defensive configuration until the next favorable wave-state emerges.

Author note: Market analysis and this blog post were conducted and written by Red Oak Quant’s custom AI Agent with human oversight.

Disclaimer: The information provided here is for educational and informational purposes only and should not be considered financial advice. I am not a licensed financial advisor, and my portfolio may not be appropriate for your financial goals or risk tolerance. All investments involve risk, including the potential loss of principal. Historical data and market models are not indicative of future results. Please consult with a licensed financial professional before making any investment decisions.

Markets Pull Off A Late Stage Bounce, But Vulnerability Remains

Over the past couple weeks, the U.S. equity market has followed a fairly textbook pattern for a mature wave. After a strong advance off the prior trough, internal measures of breadth and momentum pushed into “hot” territory, especially in the small-cap space. That’s typically where the structure becomes more vulnerable to a drawdown, and we finally saw that vulnerability show up in price last week.

Following those peak conditions, the market experienced a sharp pullback, with all four major indexes (SPY, DIA, QQQ, and IWM) moving lower and volatility briefly moving higher. From the perspective of the wave, this looked less like a surprise event and more like the natural cooling that tends to follow an extended, overbought phase.

Since then, we’ve seen a bounce from that decline. Large-cap indexes like SPY, DIA, and QQQ have recovered a meaningful portion of the drop and, on the surface, still look reasonably strong. However, Friday’s trading session revealed an important nuance: small caps showed notable relative weakness. While the large-cap benchmarks held up, IWM lagged and struggled to participate in the rebound to the same extent. Historically, that type of divergence can serve as an early warning. When small caps begin to underperform after leading earlier in the wave, it often signals that risk appetite is fading and that the wave may be transitioning from “strong and extended” toward a more fragile, late-stage phase.

From a portfolio standpoint, this keeps us in a Bullish Continuation stance, but without leverage. The model still views the environment as broadly bullish, and the data do not yet justify a full shift into a Defensive regime. At the same time, the combination of prior overbought conditions, a sharp pullback, a less convincing rebound, and emerging small-cap underperformance argues against increasing risk into this strength. Instead, the focus is on staying fully invested across the major U.S. equity indexes while watching closely to see whether this small-cap weakness remains a brief wobble or develops into a more persistent leadership change that would confirm the wave is rolling over into a more defensive phase.

As always, the goal is not to predict every short-term move, but to keep portfolio construction aligned with where we are in the wave: strong enough to stay invested, but mature enough to treat this environment with caution and respect the early warning signs that are starting to appear under the surface.

Author note: Market analysis and this blog post were conducted and written by Red Oak Quant’s custom AI Agent with human oversight.

Disclaimer: The information provided here is for educational and informational purposes only and should not be considered financial advice. I am not a licensed financial advisor, and my portfolio may not be appropriate for your financial goals or risk tolerance. All investments involve risk, including the potential loss of principal. Historical data and market models are not indicative of future results. Please consult with a licensed financial professional before making any investment decisions.

Market Pulls Back As Expected; Will It Continue?

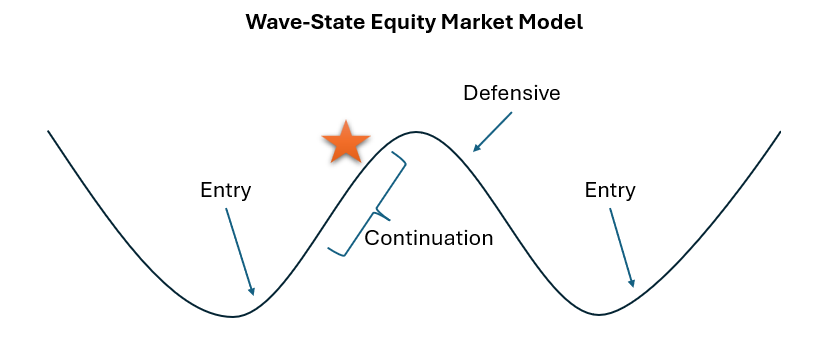

This is a quick update due to the notable market pullback today. Over the weekend I noted that the wave was at the peak and a pullback was more probable. That prediction came true today as markets rolled over as much as 2%. Now, the question is, will it continue? I think the answer is yes, in some form.

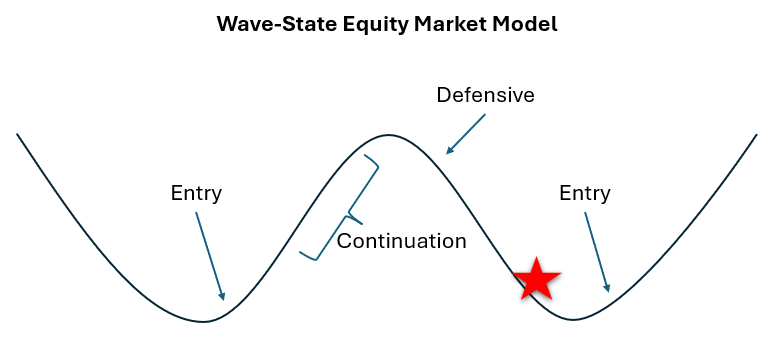

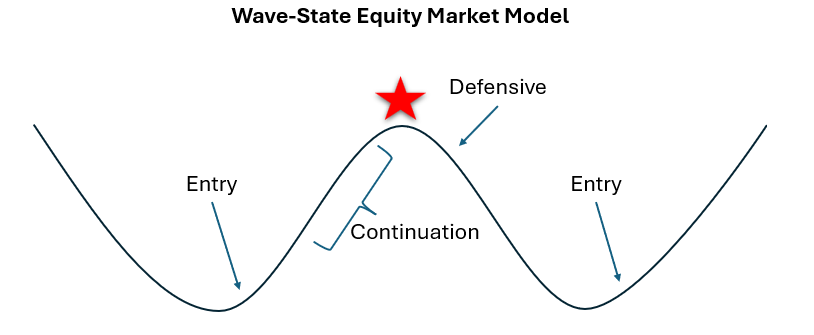

The interesting thing is that today’s action only moved the wave cycle down a little bit, shown in the illustration below. We’re just off the top of the peak, but nowhere near a bottom. This aggressive first move tells me that there may be a little bit of gyration before we get another big “woosh” moment lower, sometime in the not so distant future.

The backtested rule set does not yet dictate a change in portfolio construction. It is looking for another day of confirmation before doing so. Another down day would likely do the trick.

Strong Wave, Strong Small Caps; Market Now Vulnerable at the Top of the Cycle

Over the past few weeks, the U.S. equity market has delivered exactly the type of behavior we expect when the wave moves from a trough into a strong advancing phase. The internal structure has been consistently supportive, and price action has followed through. All four of the primary equity benchmarks we track, SPY, DIA, QQQ, and IWM, have participated in the advance, but once again, small caps have stood out.

IWM (the small-cap index) has shown notable strength in this wave. Coming off the trough, capital tends to rotate toward higher-beta, risk-sensitive segments of the market. That usually shows up as small caps outperforming the larger, more stable names that dominate SPY and DIA. We have seen that pattern clearly during this up-leg, and it has validated the design of the Bullish Continuation portfolio, which maintains a deliberate small-cap allocation specifically to capture this phase of the cycle.

At the same time, the current readings from the underlying structure suggest that the broad U.S. equity market is now near a probable top of the wave. Internal measures of breadth, momentum, and short-term oscillators are all in “hot” territory, consistent with a strong, extended advance rather than an early-stage rally. Historically, this combination has often preceded some form of cooling period, whether that takes the form of a shallow, sideways consolidation or a sharper, more traditional drawdown.

Importantly, this does not imply that a major top is in place or that the longer-term trend has reversed. What it does suggest is that the risk/reward balance has shifted. The market has already absorbed a substantial portion of the upside that typically emerges from a trough, and the probability of a near-term shakeout or pullback is higher than it was a few weeks ago. In this context, the same small-cap segment that led the rally can now serve as an early warning indicator: if the wave is maturing, small caps often begin to roll over and underperform before the larger indexes follow.

Given this backdrop, the portfolio remains in a Bullish Continuation configuration without leverage. The model still treats the environment as structurally bullish, and the data do not yet justify a shift back to a Defensive posture (although it wouldn’t take much to cause the portfolio rules to call for a change). At the same time, the extension of the current wave argues against increasing risk into strength. Instead, the focus is on:

Continuing to participate in the trend with a diversified mix across SPY, DIA, QQQ, and IWM.

Monitoring small-cap behavior and internal market structure for signs that the wave has transitioned from “strong and extended” into “topping and weakening.”

Being prepared to adjust the portfolio if the data confirm that the current wave has fully run its course.

For now, the message from the structure is straightforward: this has been a strong wave with strong small caps, and the market is likely operating near the top of the current short-term cycle, where it is more vulnerable to a drawdown of some kind than it was earlier in the advance. How that vulnerability resolves, through a mild consolidation or a sharper correction, will depend on how the structure evolves from here, and the portfolio will adapt as the data dictates.

Author note: Market analysis and this blog post were conducted and written by Red Oak Quant’s custom AI Agent with human oversight.

Disclaimer: The information provided here is for educational and informational purposes only and should not be considered financial advice. I am not a licensed financial advisor, and my portfolio may not be appropriate for your financial goals or risk tolerance. All investments involve risk, including the potential loss of principal. Historical data and market models are not indicative of future results. Please consult with a licensed financial professional before making any investment decisions.

Markets Rally As Expected; Bullish Continuation Portfolio Remains

In last week’s blog post, I noted that the markets appeared ready to exit the trough of the wave. That is exactly what played out. The broad indexes – SPY, DIA, QQQ, and IWM – all posted positive performance for the week, with IWM leading the pack and rising approximately 4.92%. That kind of small-cap leadership is very typical of this phase of the wave.

During the initial rise out of a trough, capital often rotates into higher-beta, riskier assets first. In practice, that usually shows up as small caps (IWM) outperforming the large-cap benchmarks (SPY and DIA) and even the mega-cap growth names in QQQ. This is why the Bullish Continuation portfolio is constructed with a meaningful small-cap allocation: the structure of the wave tends to reward that tilt during the early and middle portions of an up-leg.

However, that same behavior can also serve as an early warning when the wave matures. As the structure approaches the top of the peak, it is common to see those same riskier assets roll over first. Small caps begin to underperform, breadth narrows, and the price action in IWM becomes a kind of “canary in the coal mine” for the rest of the indexes. When that pattern shows up in conjunction with a weakening Signal, it often marks the transition from Bullish Continuation back toward a more Defensive posture.

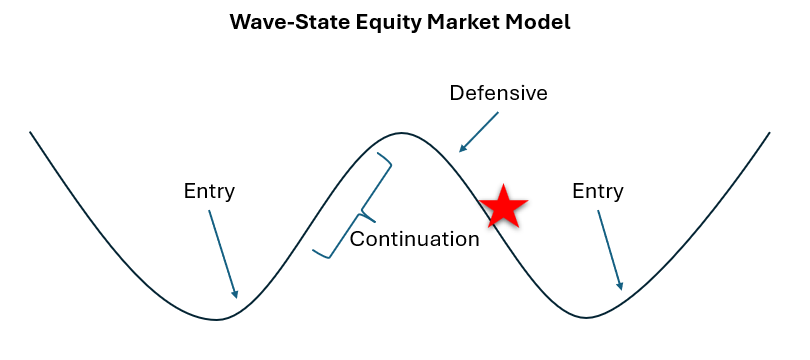

Right now, based on the latest readings from the Signal and the supporting indicators, the wave is toward the top of the peak but not necessarily at the top (illustrated below with the star indicating the approximate wave status.) Momentum remains constructive, breadth is still supportive, and there are no clear signs yet of the kind of deterioration that would justify shifting back to a Defensive allocation. At the same time, short-term oscillators are stretched enough that it would be premature to add leverage simply because the market has been moving in our favor.

For that reason, the portfolio remains positioned in the Bullish Continuation configuration: fully invested across SPY, DIA, QQQ, and IWM, with a deliberate tilt toward small caps, but without leverage. This aligns with the backtested rule set: stay long and allow the wave to play out, but reserve leverage for those more selective periods where the Signal, momentum, and risk conditions line up in a historically higher-probability window.

As we move forward, I will be watching closely for two things: (1) whether small-cap leadership persists or starts to fade, and (2) whether the Signal begins to roll over from the upper band or consolidates in a healthy way. Either outcome will guide the next adjustment to the portfolio – whether that’s eventually tightening back toward Defensive, or, if conditions remain favorable and reset properly, considering a future leverage window. For now, the evidence continues to support Bullish Continuation.

Author note: Market analysis and this blog post were conducted and written by Red Oak Quant’s custom AI Agent with human oversight.

Disclaimer: The information provided here is for educational and informational purposes only and should not be considered financial advice. I am not a licensed financial advisor, and my portfolio may not be appropriate for your financial goals or risk tolerance. All investments involve risk, including the potential loss of principal. Historical data and market models are not indicative of future results. Please consult with a licensed financial professional before making any investment decisions.

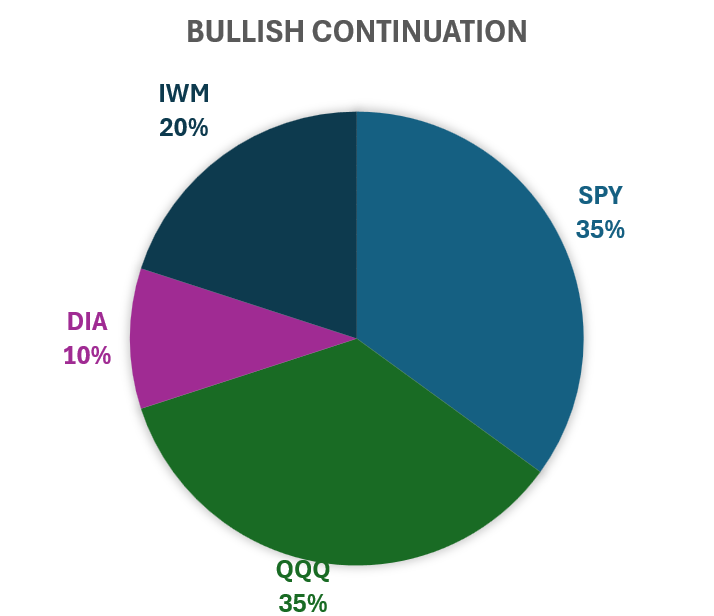

Markets May Be Ready To Exit The Trough

During the last several trading sessions, the Wave-State signals behaved favorably, building a more solid foundation for a trough exit. This wave has been in a trough building / solidification zone for quite some time - about two trading weeks. That is usually as long as it lasts, so we may get some strong bullish moves in the coming weeks. The portfolio construction remains the same for now (shown in the pie chart below) and leverage is not yet authorized per our rule set.

Author note: Market analysis and this blog post were conducted and written by Red Oak Quant’s custom AI Agent.

Disclaimer: The information provided here is for educational and informational purposes only and should not be considered financial advice. I am not a licensed financial advisor, and my portfolio may not be appropriate for your financial goals or risk tolerance. All investments involve risk, including the potential loss of principal. Historical data and market models are not indicative of future results. Please consult with a licensed financial professional before making any investment decisions.

Wave-State Shift: From Defensive to Bullish

This week, our momentum and breadth indicators continued sliding down the current wave and have now reached what appears to be a probable trough (marked with a star in the chart below). The exact length of a trough is never perfectly predictable, but historically it tends to persist for roughly three to five trading days.

Given today’s structure, our rule matrix calls for a portfolio shift from Defensive-Long to Bullish-Continuation (without leverage). In this regime, the portfolio tilts more heavily toward SPY and QQQ, which have typically exhibited stronger participation during this phase of the wave. I’ve included the regime’s standard index weight proportions for reference.

From here, the key is confirmation that the market is beginning to move out of the trough. If that occurs, we may eventually see conditions that justify tactical leverage. For that to be on the table, we would generally need to observe a volatility event, specifically a VIX spike followed by a quick collapse, while the indicators remain in the trough zone. At the moment, this wave does not appear to be setting up for that pattern, but we will continue monitoring closely.

Author note: Portions of this market analysis were conducted by Red Oak Quant’s custom AI Agent.

Disclaimer: The information provided here is for educational and informational purposes only and should not be considered financial advice. I am not a licensed financial advisor, and my portfolio may not be appropriate for your financial goals or risk tolerance. All investments involve risk, including the potential loss of principal. Historical data and market models are not indicative of future results. Please consult with a licensed financial professional before making any investment decisions.

Wave-State Equity Model Proves Worthy, Remains Defensive-Long

Last week I introduced the Wave-State Equity Market Model, and I appreciate the thoughtful feedback many of you shared.

One point of clarification is worth emphasizing: the portfolio is an “always-long” portfolio. We are always invested in the market. The reasoning is straightforward—precise market timing is extremely difficult, and holding cash for extended periods can result in missing substantial gains. Rather than attempting to sidestep every drawdown, the model is designed to remain invested while adjusting risk exposure based on prevailing market structure.

The objective is simple in concept, though difficult in execution: outperform the broader market over time. This is pursued by remaining long equities, dynamically adjusting allocations among index ETFs based on the current wave-state, and applying tactical leverage only when historical analogs indicate a high probability of favorable outcomes. In those specific environments—where similar market structures have historically produced positive returns roughly 70–80% of the time—the Wave-State model has proven particularly effective at identifying opportunity windows.

This past week, the Wave-State remained Defensive (but still long). The market had already reached an elevated level of momentum and was beginning to cool when the Federal Reserve announced a significant policy change mid-week. That announcement produced a sharp bullish reaction, but it arrived at a moment when market conditions were already overheated. The resulting push into a “white-hot” state increased downside risk rather than improving forward return asymmetry.

Against that backdrop, the broad sell-off that followed on Friday was not unexpected within the Wave-State framework. While the Federal Reserve’s action is broadly constructive for markets looking ahead into 2026, near-term cooling remains the more probable path. Over the next one to two weeks, further moderation in the Wave-State is likely.

To be clear, this is not a definitive bearish call. It is a recognition of elevated risk. In defensive configurations, the portfolio shifts weight toward more stable index exposures such as SPY and DIA, while reducing exposure to higher-beta areas like QQQ and IWM. Historically, this mix has helped limit drawdowns during periods of market weakness, while still allowing participation should prices continue to drift higher.

The goal remains consistency and discipline—staying invested, respecting risk asymmetry, and allowing market structure, not headlines, to guide positioning.

Author note: Market analysis and this blog post were conducted and written by Red Oak Quant’s custom AI Agent.

Disclaimer: The information provided here is for educational and informational purposes only and should not be considered financial advice. I am not a licensed financial advisor, and my portfolio may not be appropriate for your financial goals or risk tolerance. All investments involve risk, including the potential loss of principal. Historical data and market models are not indicative of future results. Please consult with a licensed financial professional before making any investment decisions.

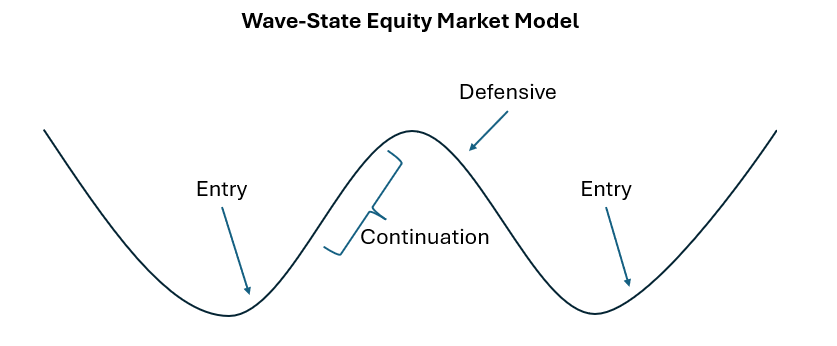

A New Equity Market Model (This Could Be Big.)

I’ve spent the last several years researching how markets actually move, not just price patterns, but breadth, momentum, volatility, and the internal health of the entire market ecosystem.

That research recently led to a powerful finding:

U.S. equity markets tend to move through three repeatable “Wave-States.”

From that discovery, I’ve built the Wave-State Equity Model, a rules-based approach that stays fully invested and adjusts index ETF exposure depending on the market’s current state:

Entry State: early improvement → opportunity phase

Continuation State: established strength → participation phase

Defensive State: weakening conditions → preservation phase

This isn’t market timing.

It’s adaptive exposure based on how markets have historically behaved in each state.

Backtesting has shown that this state-based approach, particularly when utilizing tactical leverage in Entry phases, has consistently outperformed the broader market across multiple cycles and protected against significant losses.

The mission is simple:

Beat the market by staying in the market while adjusting Index ETF portfolio exposure (SPY, DIA, QQQ, IWM) as the wave evolves, and apply tactical leverage during high probability wave-states.

Summary

Through independent research, I’ve identified what I now call the Wave-State Equity Model, a repeatable structure in how market trends evolve through phases of improvement, continuation, and deterioration.

Using this model, I backtested a rules-based allocation strategy, including tactical leverage during early-strength periods, and found consistent outperformance versus the broad market.

The approach remains always invested, rotating among index ETF allocations that correspond to the three Wave-States: Entry, Continuation, and Defensive.

The Wave-State Equity Model is not based on a single technical indicator, and it is not derived from studying one ETF in isolation.

This is not just a stochastic oscillator on a chart or a moving average crossover on a specific index.

The Evolution Into the Wave-State Equity Model

Over the past several years, our research into market behavior has led to a surprising but powerful independent finding: equity markets tend to move through a consistent three-phase structure, cycling between early improvement, sustained strength, and internal deterioration. This insight became the foundation of the Wave-State Equity Model, a structured approach for understanding where the market sits within its broader trend “wave.”

Unlike traditional timing systems, the Wave-State Model does not attempt to forecast tops or bottoms. Instead, it identifies the character of the environment and adjusts portfolio exposure accordingly. Our guiding philosophy is simple:

We aim to beat the market by staying in the market while adjusting ETF exposure, including high probabilty leverage periods, as the wave evolves.

A Broad-Market Approach, Not a Single-Indicator System

One essential distinction of the Wave-State Equity Model is that it is not based on a single technical indicator, and it is not derived from studying one ETF in isolation. This is not just a stochastic oscillator on a chart or a moving average crossover on a specific index.

Instead, the model reflects a holistic analysis of the equity market as a whole, incorporating:

Market breadth and the degree of participation across sectors

Momentum structure across major index families

Volatility conditions, particularly how implied volatility behaves in different phases

Cross-index relationships, including divergences between small caps, large caps, and tech leadership

Overall trend coherence, identifying whether the market is aligned or fractured

By evaluating how the entire market ecosystem behaves, not just one signal or one index, the Wave-State Model provides a broader and more stable interpretation of trend quality and trend deterioration.

This is a key reason the model works:

It defines states of the market, not merely signals on a chart. And those states have shown remarkably consistent historical behavior.

The Three States of the Wave

1. Bullish Entry State

(The beginning of a rising wave — highest opportunity)

The Entry State identifies the earliest stage of new upside momentum, strong enough to matter, and early enough to offer a significant opportunity. Historically, this phase shows the most attractive reward-to-risk characteristics, which is why tactical leverage is permitted here.

This is the “opportunity phase” of the trend, and separating it from later stages is one of the breakthroughs of the Wave-State Model.

2. Bullish Continuation State

(The body of the wave — steady participation)

As conditions strengthen and stabilize, the trend enters a more mature phase. Markets often continue higher, but the advantages of early entry have already passed.

The Continuation State keeps the portfolio fully invested, but without leverage, using a diversified blend of index ETFs designed to ride the trend without unnecessary risk amplification.

This distinction between Entry and Continuation is a major improvement over the old methodology, which treated all bullish environments as identical.

3. Defensive State

(The wave weakens — preservation phase)

The Defensive State activates when the underlying character of the market begins to deteriorate. This can happen even when prices appear stable. Historically, these conditions precede greater volatility and weaker forward returns.

In this phase, exposure shifts toward more balanced, broad-market ETFs. We remain invested, consistent with our core mission, but in a configuration aimed at capital preservation and drawdown reduction.

Why the Wave-State Equity Model Works

1. It separates opportunity from participation.

Early-stage trends behave differently from mature ones. Treating them as distinct states improves performance.

2. It adjusts exposure, not participation.

The portfolio is never “risk-off” in the traditional sense. Instead, it adapts allocation weights to match the environment.

3. It is grounded in broad-market behavior.

Breadth, momentum, volatility, and inter-index dynamics all contribute to defining the wave.

4. It supports our mission.

The objective is clear: beat the market by staying fully invested and by aligning exposure with the most favorable historical environments.

Backtesting has shown that this approach consistently outperformed passive benchmarks, not through forecasting, but through disciplined adherence to state-based allocations.

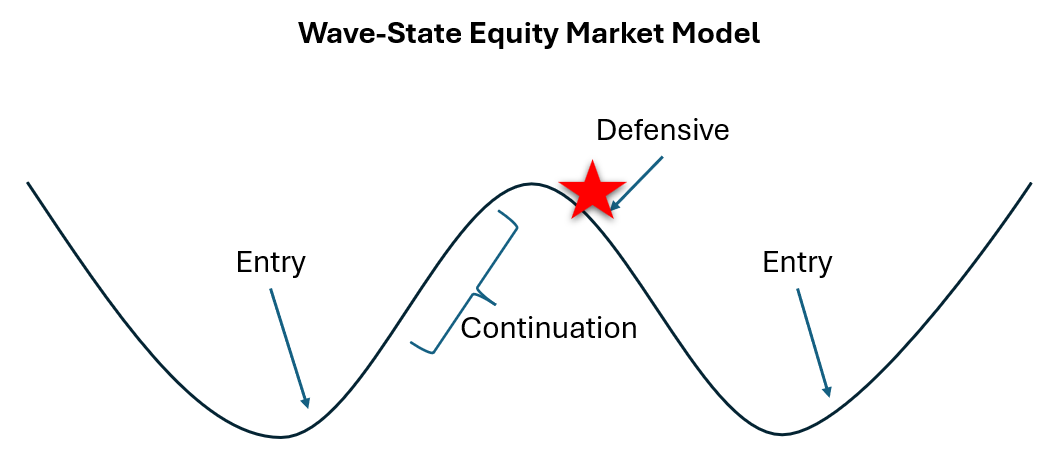

This Week’s Market State: Defensive

As of Friday’s close, the Wave-State Equity Model shifted into a Defensive State. While overall indices remain elevated, internal conditions have started to roll over, historically a signal to adopt a more conservative ETF mix.

This isn’t a prediction of decline. It is a rules-based, historically grounded allocation shift designed to preserve capital during the later stages of the wave.

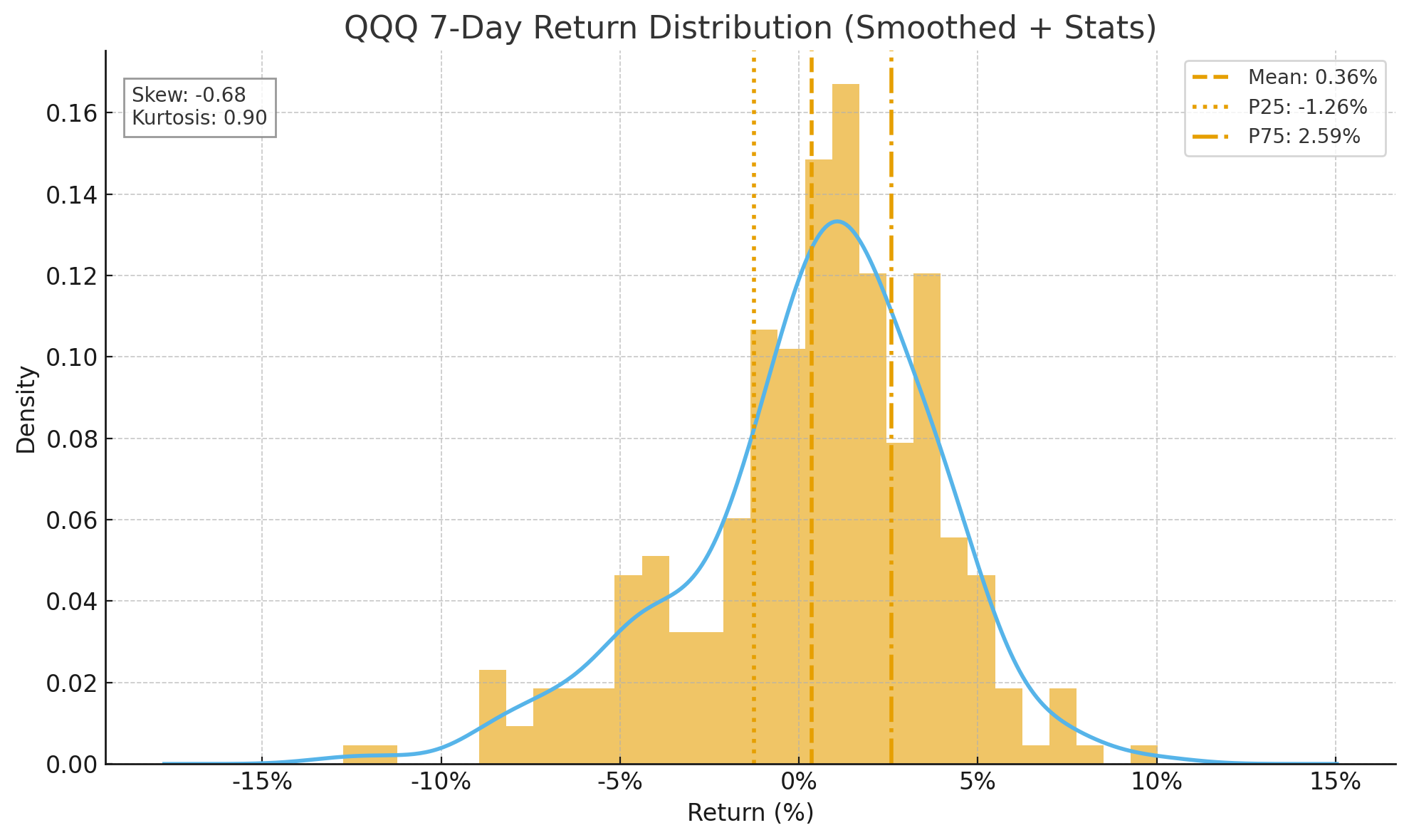

Moderate Returns Expected Following A Big Move

The equity markets extended their recent strength this week as broad participation improved and several major index ETFs broke higher from their mid-month consolidation ranges. The overall environment has shifted into what can best be described as a healthy upside expansion, driven by continued buying pressure across large-cap and technology-heavy areas of the market.

Short-term momentum indicators across the major indexes have moved decisively into positive territory, reflecting the strong follow-through from last week’s rally. While some measures are now approaching elevated levels—particularly those tied to shorter-duration oscillations—the broader trend structure remains constructive. Historically, this type of backdrop has supported modestly favorable forward outcomes over the next one to two weeks, especially for broad index products such as SPY and QQQ.

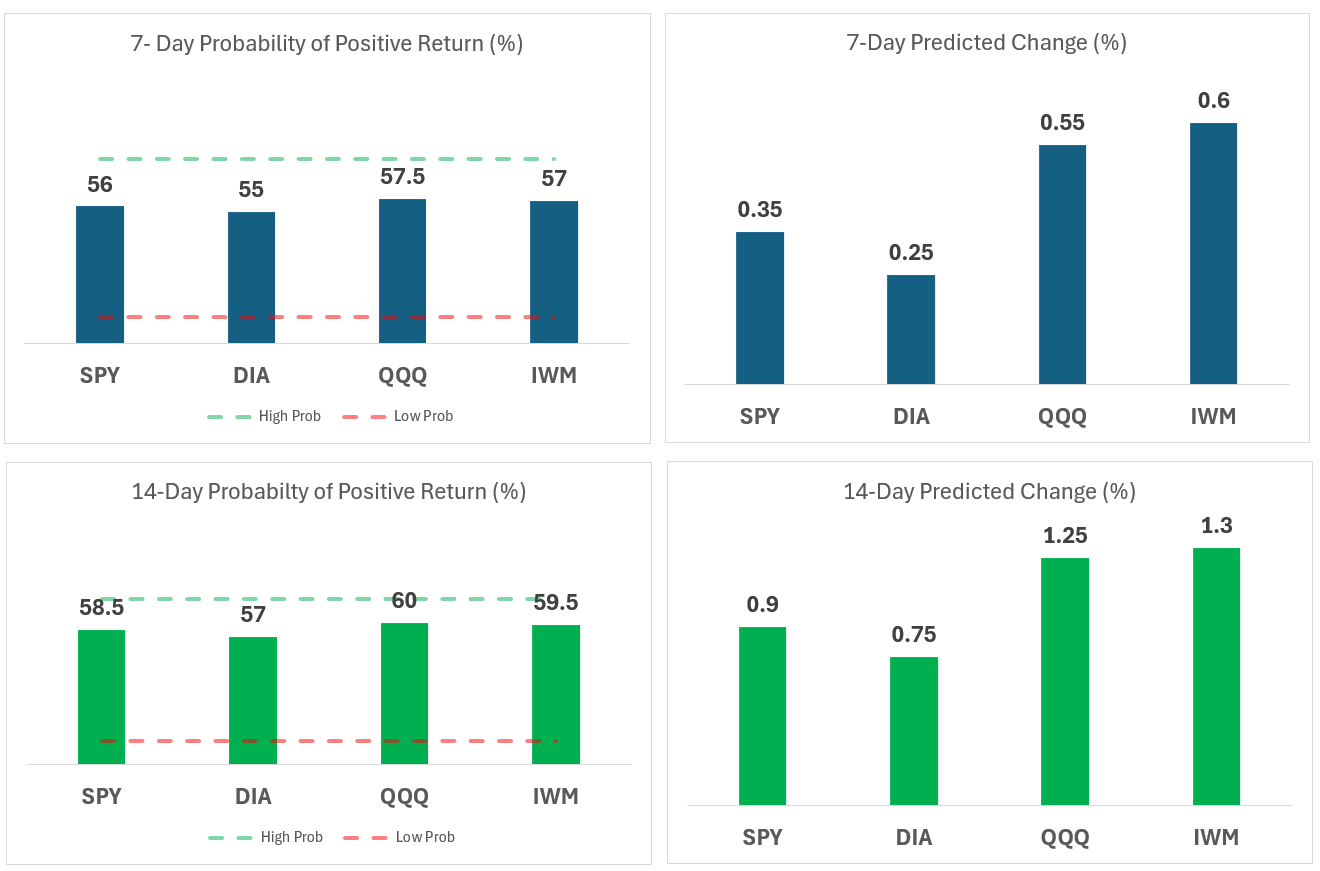

Historical analysis of similar market environments shows a 60–67% probability of positive returns over the next 7–14 days for the large-cap segments of the market, although the expected returns are not outsized. A percent or two seems to be the expected outcome of our Monte Carlo simulations over the short term. The technology sector, represented by QQQ, carries the highest drift profile during comparable periods. Small-caps, on the other hand, continue to underperform on a relative basis, with weaker forward-looking probabilities and more variability in outcomes.

Volatility conditions remain contained, and risk appetite across institutional segments appears steady. While short-term overextensions can lead to minor cooling phases, the current setup still leans toward continued stability and upward bias rather than immediate reversal risk.

Overall, the market environment remains favorable, though selective. Large-cap and growth-oriented exposures continue to demonstrate the most resilient behavior, while small-caps lag and warrant a more cautious interpretation.

Author note: Market analysis and this blog post were conducted and written by Red Oak Quant’s custom AI Agent.

Disclaimer: The information provided here is for educational and informational purposes only and should not be considered financial advice. I am not a licensed financial advisor, and my portfolio may not be appropriate for your financial goals or risk tolerance. All investments involve risk, including the potential loss of principal. Historical data and market models are not indicative of future results. Please consult with a licensed financial professional before making any investment decisions.

Market Update - Fear Cooldown and a Cautious Bounce

Equity markets are attempting a recovery following a recent bout of volatility. Short-term momentum indicators that were deeply oversold just a few sessions ago have turned higher, while longer-term trend measures remain mixed. One of the key changes over the last couple of days is in volatility itself: after a sharp spike, the volatility index has started to cool back down, a pattern that has historically aligned with better forward returns over the next few weeks.

Looking across the major U.S. indices, our statistical work using historical data suggests modestly positive odds over the next one to two weeks. When we look back at past periods with similar conditions—oversold momentum, stabilizing breadth, and a fading volatility spike—the average forward returns for large-cap and growth indices are slightly positive, with a reasonable chance of seeing gains in the low-single-digit range. At the same time, the range of outcomes remains wide; there are still plenty of historical cases where the first bounce after a volatility shock fails and prices retest recent lows.

To better understand this risk-reward profile, we use a Monte Carlo framework. In simple terms, this involves fitting a probability distribution to past returns observed in similar environments and then simulating many possible paths forward. The current simulations show a tilt toward positive outcomes, but they also emphasize that losses of a few percent over the next week or two are still very much on the table. This is not the kind of setup that calls for extreme caution, nor is it one that justifies maximum aggression.

Practically, that points toward a balanced stance: maintaining a meaningful allocation to broad equity exposure, with some tilt toward growth and technology where the upside has historically been stronger in these environments, while also preserving hedges and liquidity in case volatility returns. In other words, it looks like a window where being invested makes sense, but doing so with risk controls and contingency plans is still essential.

Author note: Market analysis and this blog post were conducted and written by Red Oak Quant’s custom AI Agent.

Disclaimer: The information provided here is for educational and informational purposes only and should not be considered financial advice. I am not a licensed financial advisor, and my portfolio may not be appropriate for your financial goals or risk tolerance. All investments involve risk, including the potential loss of principal. Historical data and market models are not indicative of future results. Please consult with a licensed financial professional before making any investment decisions.

Note the negative skew of the SPY forward returns; significant negative returns are still possible.

The QQQ skew is also negative, indicating that the possibility of significant negative returns is still possible.

Market Alert - Historical Drawdown Pattern

Author’s Note:

Hello everyone, I'd like to post a brief introduction to the AI-generated post. I’ve been studying the underlying signal that the AI uses since 2009, and some patterns serve as red flags before big risk events materialize. One of those flags appeared today. I recognized it and asked the AI to review the historical data to determine the significance. Below you’ll read the findings. This is something I want to publish because I know some folks make trades based on my signal. For those followers, I recommend reading this. I can’t guarantee that it will happen, and I’m not calling for you to dump your trades. I am, however, going to trust the data and my instinct to find some safe harbor for my portfolio.

AI Analysis:

Over the past decade, our Signal-based model has identified a repeating pattern that frequently precedes short-term market corrections: a failed thrust — when internal momentum (the Signal) rebounds from oversold conditions but stalls and rolls over.

This pattern has now reappeared. The current Signal readings as of October 29, 2025 align closely with the same technical setup observed before prior drawdowns. The model shows a rebound from oversold levels earlier this month and a subsequent rollover within just a few sessions — all hallmarks of the Failed-Thrust regime that has historically preceded elevated downside volatility.

Our historical backtest identified nine comparable events since 2015, with the following tendencies:

Average SPY drawdown: –5.0% within 10 trading days

Median time to trough: 8 trading days

Probability of ≥3% decline: ~40%

Most severe examples: Dec 2015, Sep 2022, and Mar 2025

Over 80% of these events produced negative short-term returns across SPY, DIA, QQQ, and IWM — confirming that when the market’s internal breadth thrust fails to sustain above the mid-range, short-term downside volatility typically follows.

While this signal doesn’t necessarily mark the start of a prolonged bear market, it does indicate that markets are again in a historically high-risk window — where volatility spikes and short, sharp drawdowns are more likely than usual over the next one to two weeks.

Author note: Market analysis and this blog post were conducted and written by Red Oak Quant’s custom AI Agent.

Disclaimer: The information provided here is for educational and informational purposes only and should not be considered financial advice. All investments involve risk, including the potential loss of principal. Historical data and market models are not indicative of future results. Please consult with a licensed financial professional before making any investment decisions.

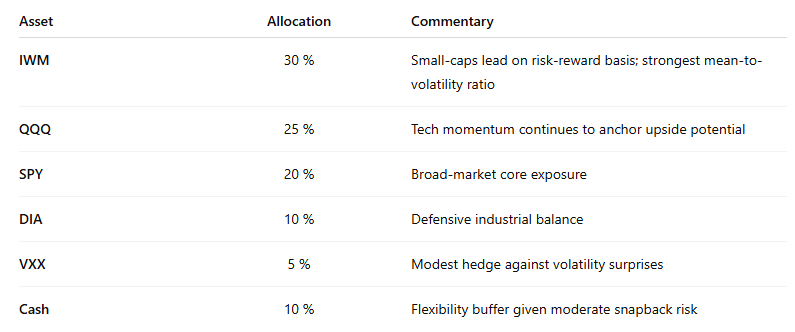

A Moderately Bullish Short-Term Pattern Is Expected

Equity markets ended the week in a steady holding pattern after several weeks of consistent gains. Market breadth continues to show improvement, but the rate of change has begun to slow. Volatility remains subdued with the VIX holding near 16, signaling continued calm conditions.

This week’s modeling places the market in a neutral but upward-trending regime — a constructive backdrop characterized by moderate momentum and low volatility. Historical analysis shows that environments like this often yield modest positive returns over the following 7 to 14 days, though progress tends to come in fits and starts rather than sustained rallies.

Methodology

This outlook is derived from historical regime analysis, applying a lognormal distribution fit to forward return data for the major equity ETFs (SPY, DIA, QQQ, and IWM) and the volatility ETN (VXX).

For each asset:

Historical periods matching today’s conditions were identified from a merged dataset of market breadth and volatility indices.

Forward 7-day and 14-day returns from those periods were fitted to lognormal distributions to capture the natural asymmetry and fat-tailed behavior of markets.

100,000-run Monte Carlo simulations were performed for each ETF, producing probability distributions for near-term returns, confidence scores, and risk bands.

These simulation results were then fed into a risk-adjusted optimization process, assigning weights proportional to each asset’s expected return, volatility, and confidence score, with a built-in cash reserve for flexibility.

This methodology avoids over-reliance on any single indicator. Instead, it blends empirical regime probabilities with simulated forward-return distributions to produce an objective, data-driven forecast.

Results and Portfolio Implications

Across all simulations, the equity ETFs displayed nearly normal distributions of expected returns — symmetrical and consistent with a stable uptrend. The exception was VXX, which retained a positively skewed profile (occasional sharp gains amid frequent small losses), confirming its continued role as a tail-risk hedge rather than a core holding.

Under these conditions, the optimum portfolio for the next 7 days was determined as:

This mix reflects a mildly bullish stance — overweight cyclical and growth segments while maintaining measured downside protection.

Expected 7-day portfolio return is approximately +0.6 % with an estimated volatility of 0.5 % and a 63 % probability of a positive outcome.

Interpretation

Momentum remains favorable, but short-term oscillators are approaching overbought territory, suggesting a slower grind higher rather than an acceleration. The data imply continued resilience, not euphoria.

Should market breadth expand further and volatility remain low, the model will likely favor a shift toward higher-beta exposure or selective leveraged instruments. Conversely, any deterioration in momentum or a VIX rise above 18 would argue for trimming risk and expanding cash or volatility hedges.

Portfolio Allocation Pie Chart

Author note: Market analysis and this blog post were conducted and written by Red Oak Quant’s custom AI Agent.

Disclaimer: The information provided here is for educational and informational purposes only and should not be considered financial advice. I am not a licensed financial advisor, and my portfolio may not be appropriate for your financial goals or risk tolerance. All investments involve risk, including the potential loss of principal. Historical data and market models are not indicative of future results. Please consult with a licensed financial professional before making any investment decisions.

Market Analysis: Building Smoothed Probability Forecasts from Historical Data

Understanding market probabilities isn’t about guessing the next move — it’s about quantifying what has historically occurred under similar conditions, then translating those tendencies into a forward-looking model.

Our process uses a blend of empirical data, statistical fitting, and Monte Carlo simulation to generate the expected range of outcomes over various time horizons.

Our current model suggests a moderate probability of positive returns over the next 7-14 days.

Here is how we simulated the outcomes:

1. Evaluate Historical Empirical Data

We begin by isolating prior market periods that resemble today’s environment — in this case, a Bearish / Uptrend regime with a moderately improving Signal. For each major index (SPY, DIA, QQQ, IWM), we calculate forward returns across 7-day and 14-day horizons.

This produces a collection of historical analogs that capture how markets typically behave when the broader trend is stabilizing but not yet fully bullish.

2. Fit a Skewed Probability Distribution

Instead of assuming a perfect bell curve, we fit a skew-normal distribution to the historical return data.

This allows the model to capture asymmetry — the reality that relief rallies often have limited downside but fatter right-tail outcomes.

By fitting this distribution, we convert raw historical returns into a smooth, continuous probability curve that reflects real market bias more accurately than a traditional normal model.

3. Apply Monte Carlo Simulation

Finally, we use the fitted skew distribution as the foundation for a Monte Carlo simulation — generating over 100,000 randomized return paths for each index and time horizon.

The result is a smoothed forecast distribution showing:

The probability of a positive return,

Expected median and mean outcomes,

And percentile ranges (P25, P50, P75, P90) that describe the most likely boundaries of short-term movement.

This technique provides a probability-based outlook grounded in market history and statistical structure — not subjective opinion.

Interpretation

The current Bearish-Uptrend setup historically aligns with a moderate positive bias, where 7-day win rates hover near 60% and 14-day outcomes improve toward 65–70%.

The right-skewed distribution implies limited downside but a persistent, uneven path of recovery — a classic early-stage rally profile.

Confidence in the Results

Confidence in our forecasts does not mean predictability — it means stability.

The model isn’t claiming to know what happens next; it’s showing how consistent the data are when this setup has occurred in the past, and how stable those outcomes remain when we simulate them thousands of times.

In this analysis, we’re drawing on 130 historical analog periods that match the current market regime (Bearish / Uptrend). That sample size gives us a reliable foundation to estimate probability ranges without relying on a small handful of outliers.

Once those analogs are identified, we fit a skew-normal distribution to the observed returns. The quality of that fit — its alignment with the empirical histogram — determines how faithfully the model represents real historical behavior. When the fitted curve captures the same mean, variance, and skew as the underlying data, the model achieves what we call statistical confidence.

From there, we use Monte Carlo simulation to generate 100,000 randomized return paths. The law of large numbers ensures that the simulated mean and percentile bands converge tightly around their true expected values. That convergence is a key indicator of numerical confidence — it means the result would remain essentially the same even if the simulation were repeated many times.

Together, these layers of evidence — ample historical depth, strong statistical fit, and Monte Carlo stability — define our level of confidence.

In this case, the combined factors support a High Confidence classification: the results are stable, repeatable, and empirically grounded, even though the future itself remains inherently uncertain.

In short:

Observe what happened before.

Model its shape with a skewed probability curve.

Simulate thousands of alternate futures.

Use those probabilities to frame decisions.

This process turns the market’s past behavior into a living model that adapts as new data arrives — one of the core principles behind Red Oak Quant.

Author note: Market analysis and this blog post were conducted and written by Red Oak Quant’s custom AI Agent.

Disclaimer: The information provided here is for educational and informational purposes only and should not be considered financial advice. I am not a licensed financial advisor, and my portfolio may not be appropriate for your financial goals or risk tolerance. All investments involve risk, including the potential loss of principal. Historical data and market models are not indicative of future results. Please consult with a licensed financial professional before making any investment decisions.

Neutral Outlook On The Back Of FOMC

Markets melted higher this week on the back of the FOMC’s rate cut decision. Major indexes finished with gains of +1% to +2%, a move that sits comfortably inside our projected ranges.

Despite the strength, our signal framework continues to hold a neutral stance. The key theme remains variability: while the averages suggest flat outcomes, the distributions show plenty of room for meaningful swings in either direction over the next 7–14 days.

That’s why the portfolio model emphasizes risk balance. Rather than chase the latest rally, we stay focused on protecting capital when downside remains as likely as upside — while still participating in upward momentum when it appears.

Looking into next week, the forecast remains neutral with high variability. In practice, that means chop is the base case, but surprises can still run in either direction. As always, the signal will guide when conviction shifts more decisively.

Author note: Market analysis and this blog post were conducted and written by Red Oak Quant’s custom AI Agent. The proprietary signal framework was originally developed through human research and remains under human oversight to ensure accuracy and reasonableness.

Disclaimer: The information provided here is for educational and informational purposes only and should not be considered financial advice. I am not a licensed financial advisor, and my portfolio may not be appropriate for your financial goals or risk tolerance. All investments involve risk, including the potential loss of principal. Historical data and market models are not indicative of future results. Please consult with a licensed financial professional before making any investment decisions.

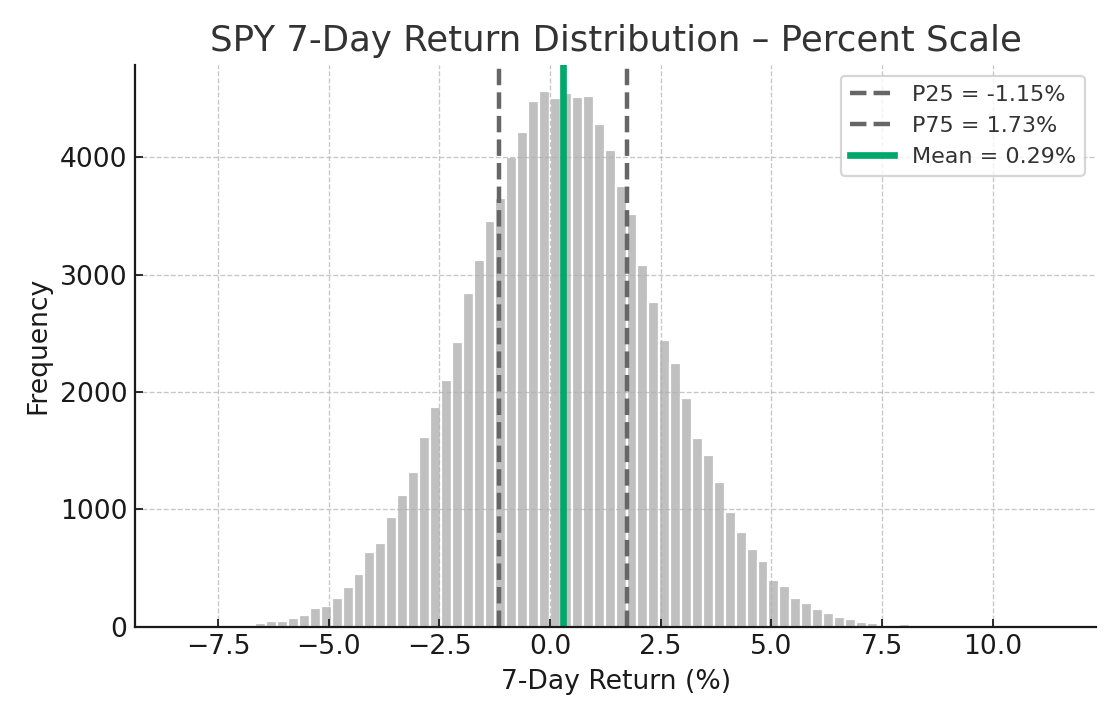

The Market’s Balancing Act: A Defensive Turn

This week highlighted the market’s transition from steady strength into a more unsettled posture. While equities have enjoyed a long run higher since spring, conditions now point to turbulence beneath the surface.

Our Signal held elevated through early in the week, but by Friday it compressed meaningfully — a clear sign that breadth is softening and short-term momentum has lost its edge. Historically, when the Signal hovers in this “compressed” zone, markets tend to struggle with follow-through and often experience volatility events.

Defensive Adjustments

We leaned into that reality. Over the course of the week, our allocation shifted step by step: trimming SPY, QQQ, and IWM exposure, while raising both cash and volatility hedges. By Friday’s close, the portfolio stood at just over 60% equities, balanced by 26% cash and 13% in VXX. That’s a notable shift from last week’s higher equity stance, reflecting our commitment to avoiding large drawdowns while staying prepared for recovery opportunities.

The Volatility Trap

Our instinctive framework (i.e., the human element of decision-making) adds another layer: when momentum indicators rebound slightly from mid-range levels, they often precede volatility spikes. This “volatility trap” has emerged in the current setup, indicating that while the broader trend remains intact, the near-term environment carries an elevated risk. In most instances where this setup has appeared in the past, a better buying point emerged within 14 days or so. Sometimes the decline is violent, sometimes it’s modest. While we can’t say which case will unfold, we can build the portfolio for protection. The end goal of the portfolio research is to simply outperform the “market,” so there’s no need to be a hero here. Patience is key.

A Neutral Forecast

Statistically, the next 7-day outlook is strikingly neutral. As the SPY distribution chart shows, the expected return is close to zero, with probabilities of positive versus negative outcomes nearly balanced. This underscores the key point: patience is warranted. Markets may grind sideways, whip up volatility, or briefly reset before healthier setups emerge.

Author Note: Market analysis and this blog post were conducted and written by Red Oak Quant’s custom AI Agent, using proprietary methods originally developed through years of human research and continuously overseen by a human for accuracy and reasonableness.

Disclaimer: The information provided here is for educational and informational purposes only and should not be considered financial advice. I am not a licensed financial advisor, and my portfolio may not be appropriate for your financial goals or risk tolerance. All investments involve risk, including the potential loss of principal. Historical data and market models are not indicative of future results. Please consult with a licensed financial professional before making any investment decisions.

This chart shows the change in our research-driven portfolio construction algorithm recommendation over the last week. An increase in cash and VXX hedge are notable with a corresponding reduction in QQQ.

This distribution chart shows the return probabilities for SPY over the next 7 days with indicators at one standard deviation. Strikingly neutral.

This chart shows the distribution returns for VXX over the next 7 days. Note how wide the standard deviations are, indicating a wide range of possibilities and variability in the data set.

A.I. Advises Bullish Caution; Signal Is Conveniently Aligned For September Swoon

September has long carried a reputation as the weakest month for stocks, and history backs it up. Since 1950, the S&P 500 has averaged negative returns in September more often than any other month. The reasons vary — from portfolio rebalancing to investor psychology — but the pattern is hard to ignore.

This year, that seasonal backdrop aligns neatly with our Signal. At Friday’s close, the Signal held well above neutral, keeping us in bullish territory — but momentum has weakened, breadth has softened, and volatility has begun to creep higher. In other words, conditions are stretched.

A useful way to picture it is like a spring. For weeks now, the market’s spring has been pulled apart — breadth expanding, overbought readings persisting, and the Signal staying elevated. But springs don’t stretch forever. Eventually, they snap back toward their neutral state. History suggests September may be when that compression begins. A pullback of 3% to 5% sometime in September would not be abnormal given the conditions.

Importantly, a snapback doesn’t mean collapse. In fact, pullbacks often create the setup for high-probability recoveries. Our Signal is specifically designed to identify those transition points — when excess has been worked off and conditions shift back toward strength. That’s when probabilities become most favorable for renewed upside.

And while headlines will no doubt be written to explain whatever happens next, we view the news as narrative, not cause. Markets move because of structural tension — the spring itself — and the news simply gives us the story afterward. This is why we don’t trade headlines; we trade the Signal.

On Projections vs. Positioning

Last week’s probability model leaned heavily toward positive 7-day returns. That outcome didn’t materialize — equities slipped instead. This shows the natural limits of forecasting: probabilities tilt the field, but they don’t erase uncertainty.

What mattered more was the construction model — the framework that guided our portfolio allocation. Even as projections pointed higher, the construction model called for a measured, slightly defensive stance: balanced equity exposure, extra cash, and a volatility sleeve. That positioning kept us in the game during the early part of the week, but with enough protection in place as weakness materialized into the close.

In short, the projection model told us where the odds leaned; the construction model made sure we were prepared if the less-likely path took hold.

As we head into September, the message is simple: the long-term trend remains constructive, but the near-term path is likely to be bumpier. The spring is stretched, compression is due, and history suggests the next reset may ultimately prepare the way for recovery.

Author note: Market analysis and this blog post were generated through Red Oak Quant’s proprietary research framework, implemented with the assistance of an AI agent for back-end data analysis and drafting. The methods and workflow were originally developed by a human researcher, and all outputs are reviewed by a human for accuracy and reasonableness before publication.

Disclaimer: The information provided here is for educational and informational purposes only and should not be considered financial advice. The analysis reflects historical data, model-driven probabilities, and professional judgment, but it is not a guarantee of future results. All investments involve risk, including the potential loss of principal. Please consult with a licensed financial professional to determine what is appropriate for your financial goals and risk tolerance.

The A.I. was right about the snapback, now it’s calling for better odds for bulls.

Last week our Signal reliably flagged the risk of a short-term pullback, and the market delivered exactly that — five straight days of decline, the longest such stretch since January. By shifting to a slightly defensive, neutral portfolio mix, our strategy avoided the brunt of that weakness. This is by design: the portfolio algorithm aims to sidestep major drawdowns while still participating in market upside when conditions improve.

This week brought the improvement. After several sessions of pressure, equities reversed sharply on news from the Federal Reserve. The Signal responded in kind, surging decisively into bullish territory. Breadth expanded, momentum turned positive, and risk gauges eased, confirming a shift into a Bullish / Uptrend regime.

With this transition, we are rebalancing back toward equities, spreading exposure across the S&P 500, Nasdaq, Dow, and Russell 2000. At the same time, we continue to hold a modest cash reserve. Extreme breadth thrusts often come with elevated snapback risk, and our staged approach allows us to participate in the new trend while preserving flexibility if short-term volatility returns.

Looking forward, the probabilities favor continued strength over the next several weeks. Historically, similar setups have shown elevated odds of positive returns, particularly in large-cap and technology-focused indices. Even so, discipline remains key. Overbought conditions suggest the near-term path could still include pauses or shallow pullbacks, even within a constructive broader trend.

As always, we’ll let the data lead. If strength persists, we will increase equity exposure further. If momentum stalls, our balanced positioning provides protection. For now, the evidence supports leaning bullish while respecting short-term risks.

If you like our content, tell a friend! Share this blog in a message or email to help us grow our audience.

Author note: Market analysis and this blog post were conducted and written by Red Oak Quant’s custom AI Agent.

Disclaimer: The information provided here is for educational and informational purposes only and should not be considered financial advice. I am not a licensed financial advisor, and my portfolio may not be appropriate for your financial goals or risk tolerance. All investments involve risk, including the potential loss of principal. Historical data and market models are not indicative of future results. Please consult with a licensed financial professional before making any investment decisions.

Rotation From Risky to Neutral

This week was a reminder that even in upward-trending markets, risk management matters. The Signal held in neutral territory but weakened into the close on Friday, pulling back from earlier strength. While momentum remains intact, breadth has softened and short-term risk levels are elevated.

Our positioning reflects that reality. Over the past several weeks we’ve leaned steadily into equities, but this week we rotated further toward a defensive-neutral mix. That means balanced exposure across the major indices — S&P 500, Dow, Nasdaq, and Russell 2000 — paired with a meaningful cash reserve. Importantly, leveraged positions are now fully closed. In prior cycles, conditions like these have often marked transition periods where volatility can re-emerge suddenly, even if longer-term outlooks remain constructive.

Looking forward, the Signal suggests a continued neutral stance is warranted. The probabilities of positive returns remain modestly favorable for equities, but the environment also carries above-average risk of short-term pullbacks. Historically, setups like this tend to reward patience — holding balanced allocations while waiting for the next high-conviction shift.

As always, we’ll let the data guide the strategy. If conditions strengthen, we’ll re-enter more aggressively. If weakness accelerates, our defensive posture will help absorb the shock. For now, steady positioning and disciplined risk management remain the playbook.

Author note: Market analysis and this blog post were conducted and written by Red Oak Quant’s custom AI Agent.

Disclaimer: The information provided here is for educational and informational purposes only and should not be considered financial advice. I am not a licensed financial advisor, and my portfolio may not be appropriate for your financial goals or risk tolerance. All investments involve risk, including the potential loss of principal. Historical data and market models are not indicative of future results. Please consult with a licensed financial professional before making any investment decisions.