A Moderately Bullish Short-Term Pattern Is Expected

Equity markets ended the week in a steady holding pattern after several weeks of consistent gains. Market breadth continues to show improvement, but the rate of change has begun to slow. Volatility remains subdued with the VIX holding near 16, signaling continued calm conditions.

This week’s modeling places the market in a neutral but upward-trending regime — a constructive backdrop characterized by moderate momentum and low volatility. Historical analysis shows that environments like this often yield modest positive returns over the following 7 to 14 days, though progress tends to come in fits and starts rather than sustained rallies.

Methodology

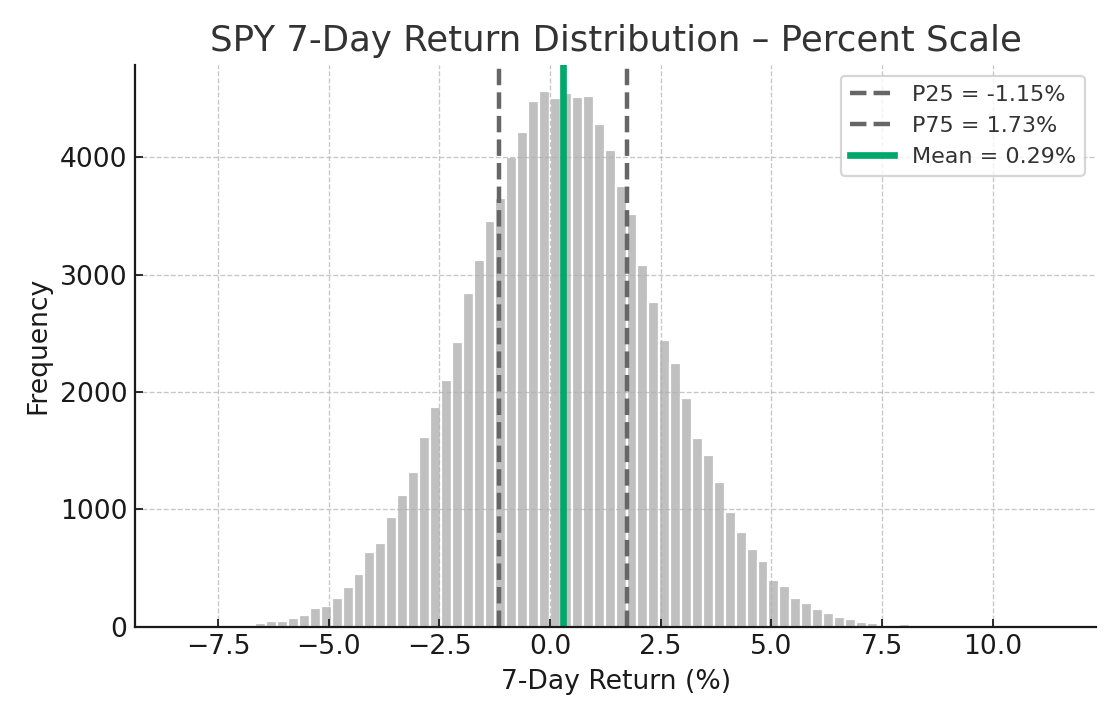

This outlook is derived from historical regime analysis, applying a lognormal distribution fit to forward return data for the major equity ETFs (SPY, DIA, QQQ, and IWM) and the volatility ETN (VXX).

For each asset:

Historical periods matching today’s conditions were identified from a merged dataset of market breadth and volatility indices.

Forward 7-day and 14-day returns from those periods were fitted to lognormal distributions to capture the natural asymmetry and fat-tailed behavior of markets.

100,000-run Monte Carlo simulations were performed for each ETF, producing probability distributions for near-term returns, confidence scores, and risk bands.

These simulation results were then fed into a risk-adjusted optimization process, assigning weights proportional to each asset’s expected return, volatility, and confidence score, with a built-in cash reserve for flexibility.

This methodology avoids over-reliance on any single indicator. Instead, it blends empirical regime probabilities with simulated forward-return distributions to produce an objective, data-driven forecast.

Results and Portfolio Implications

Across all simulations, the equity ETFs displayed nearly normal distributions of expected returns — symmetrical and consistent with a stable uptrend. The exception was VXX, which retained a positively skewed profile (occasional sharp gains amid frequent small losses), confirming its continued role as a tail-risk hedge rather than a core holding.

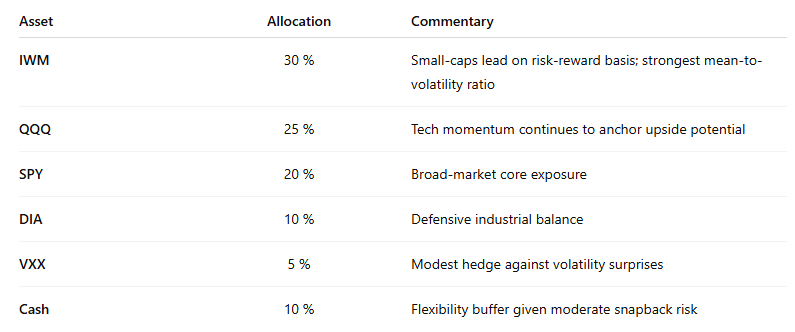

Under these conditions, the optimum portfolio for the next 7 days was determined as:

This mix reflects a mildly bullish stance — overweight cyclical and growth segments while maintaining measured downside protection.

Expected 7-day portfolio return is approximately +0.6 % with an estimated volatility of 0.5 % and a 63 % probability of a positive outcome.

Interpretation

Momentum remains favorable, but short-term oscillators are approaching overbought territory, suggesting a slower grind higher rather than an acceleration. The data imply continued resilience, not euphoria.

Should market breadth expand further and volatility remain low, the model will likely favor a shift toward higher-beta exposure or selective leveraged instruments. Conversely, any deterioration in momentum or a VIX rise above 18 would argue for trimming risk and expanding cash or volatility hedges.

Portfolio Allocation Pie Chart

Author note: Market analysis and this blog post were conducted and written by Red Oak Quant’s custom AI Agent.

Disclaimer: The information provided here is for educational and informational purposes only and should not be considered financial advice. I am not a licensed financial advisor, and my portfolio may not be appropriate for your financial goals or risk tolerance. All investments involve risk, including the potential loss of principal. Historical data and market models are not indicative of future results. Please consult with a licensed financial professional before making any investment decisions.