Weekly Update + Market Alert

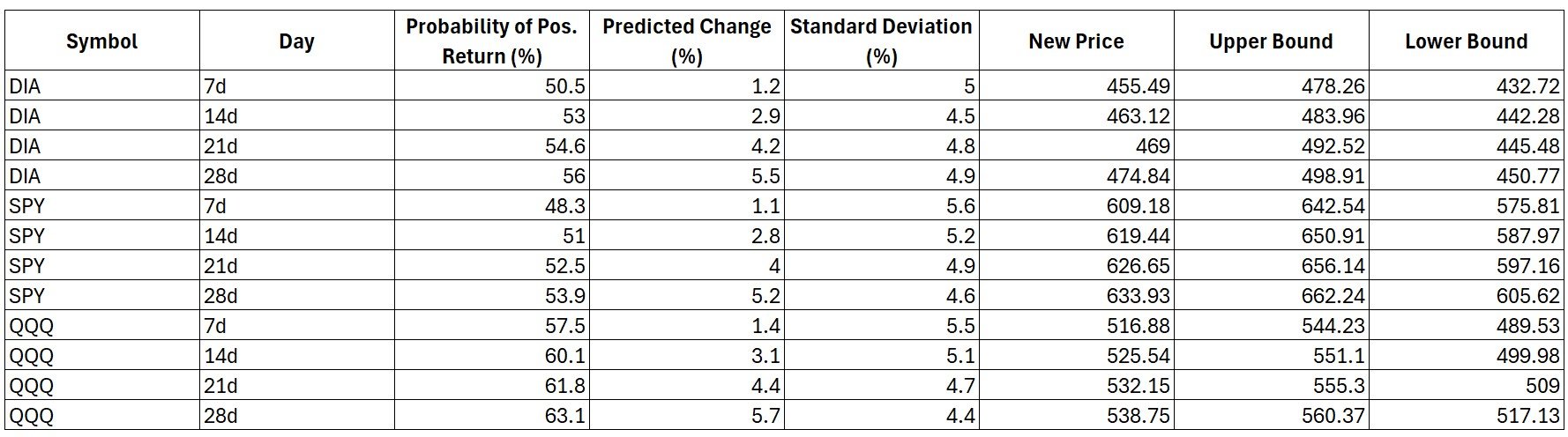

In last week’s update, we noted potential downside risks in the market, which materialized for both DIA and SPY. However, QQQ ended the week with a positive week-over-week gain. Our price targets remained well within the acceptable criteria for the quant model, and most notably, the model was exceptionally accurate for SPY, predicting a value of 604.77 compared to an actual result of 604.21.

Looking ahead to next week, our quant model indicates an increased likelihood of positive returns. The model shows a 71% probability of positive returns for DIA and SPY over the next 7 days. For QQQ, the probability is 54.1% over 7 days, rising substantially to 85% over a 14-day horizon. Given the recent run-up in QQQ, this projection aligns with broader market dynamics. Based on these probabilities, we are issuing a bullish entry window alert at this time. While some downside risks remain, the historical performance of these indices under similar conditions suggests a short- to medium-term bullish turn is likely in the coming week.

Disclaimer: The information provided here is for educational and informational purposes only and should not be interpreted as financial advice. I am not a licensed financial advisor, and my portfolio strategies may not align with your financial goals or risk tolerance. All investments carry inherent risks, including the potential loss of principal. Historical data and model-based projections are not guarantees of future performance. Please consult with a licensed financial professional before making any investment decisions.

Weekly Update 12.7.24

In last week’s update, we observed signs of early market exhaustion, though there remained potential for moderate gains. Over the course of the trading week, the QQQ and SPY indices moved higher, while the DIA experienced a slight decline. This performance aligns broadly with our model’s expectations, particularly regarding the “probability of positive return” metric. This metric indicated a neutral to slightly negative probability relative to our baseline or “nominal” market probability.

We believe this tool provides valuable insights for assessing medium-term risk tolerance within a portfolio. When the market’s probability is neutral or slightly below the nominal baseline, we aim to construct portfolios that balance the opportunity to capture slight gains with protective measures to mitigate potential downside risks.

Looking ahead to next week, our quant model continues to produce similar outputs. While the probability of positive returns remains subdued, we cannot rule out the possibility of a sudden, sharp downward move in the markets, as certain vulnerabilities persist in our model’s data.

Disclaimer: The information provided here is for educational and informational purposes only and should not be interpreted as financial advice. I am not a licensed financial advisor, and my portfolio strategies may not align with your financial goals or risk tolerance. All investments carry inherent risks, including the potential loss of principal. Historical data and model-based projections are not guarantees of future performance. Please consult with a licensed financial professional before making any investment decisions.

Weekly Update 12.1.24

In last week’s update, we noted an unusual bullish wave occurring at an unexpected point in our signal’s historical cycle. While this deviation was unprecedented, it turned out to be a favorable opportunity for those positioned bullishly in the market. This serves as a reminder that no model is flawless, and the possibility of model errors must always be accounted for when constructing a portfolio.

Looking ahead to next week, our model suggests a reduced probability of positive returns. The nominal probability of positive return is approximately 63% (as indicated by the dashed line on the chart), reflecting a long-term trend of positive returns in the market. This baseline probability slightly exceeds a 50/50 scenario due to historical market behavior. However, our quantitative model places the probability of positive returns in the 50% range for the tracked indices, signaling caution for bullish market participants. We are observing signs of early fatigue in the current market wave. If the market continues higher, the model projects modest gains in the range of 1% to 1.4%.

Disclaimer: The information provided here is for educational and informational purposes only and should not be interpreted as financial advice. I am not a licensed financial advisor, and my portfolio strategies may not align with your financial goals or risk tolerance. All investments carry inherent risks, including the potential loss of principal. Historical data and model-based projections are not guarantees of future performance. Please consult with a licensed financial professional before making any investment decisions.

Weekly Update 11.23.24

This week the market made an unexpected and unpredicted pivot upward. Our signal did not achieve any of it’s historic indications of a pivot, so we cannot endorse this pivot as “high probability.” A market pivot at this point has not happened in the last 12 months. Therefore, we are not going to publish a forecast this week. We will watch next week and see if this bullish wave holds up, or it it turns out to be a bull trap. More to come!

Weekly Update 11.15.24

In last week’s update, we highlighted the potential for market exhaustion during this week. On Tuesday, we issued a market alert indicating that our model had identified exhaustion for the current wave. Following that alert, the market did, in fact, trend lower, closing out the week with a decline on Friday.

Looking ahead to next week, our model suggests that market momentum remains biased to the downside. At this time, we do not have any indications of a high-probability bullish entry point for the medium term. Should the signal or quantitative model show a significant shift during the week, we will issue a mid-week alert.

Disclaimer: The information provided here is for educational and informational purposes only and should not be construed as financial advice. I am not a licensed financial advisor, and my portfolio may not align with your financial goals or risk tolerance. All investments involve risk, including the potential loss of principal. Historical data and model-based projections do not guarantee future performance. Please consult a licensed financial professional before making any investment decisions.

Market Alert: Exhaustion

Today our signal detected market exhaustion following the major run-up following the election. Our AI quant model (shown below) now indicates a higher probability for market stagnation or decline over the coming days.

Disclaimer: The information presented here is for educational and informational purposes only and should not be construed as financial advice. I am not a licensed financial advisor, and my portfolio may not align with your financial goals or risk tolerance. All investments carry risks, including the potential loss of principal. Historical data and model-based projections are not guarantees of future performance. Always consult a licensed financial professional before making any investment decisions.

Weekly Market Update 11.9.24

This week’s market activity aligned closely with our projections from last weekend. We identified the beginning of a market pivot, anticipated some additional downside leading up to the election, and expected a highly responsive market following the election outcome. With the signal positioned to support significant upside momentum, the market reacted strongly once election certainty was established, resulting in a substantial upward move.

Looking ahead to next week, our model suggests that the likelihood of large upside moves has diminished. However, there remains potential for continued gains, though at a more moderate pace. If we observe signs of market exhaustion within this trend, we will issue a mid-week alert.

Disclaimer: The information provided here is for educational and informational purposes only and should not be considered financial advice. I am not a licensed financial advisor, and my portfolio may not align with your financial goals or risk tolerance. All investments involve risk, including the potential loss of principal. Historical data and model-based projections do not guarantee future performance. Please consult a licensed financial professional before making any investment decisions.

Market Alert: High Probability Pivot In Progress

This week’s market activity offered some fascinating dynamics. I anticipated a mid-week pivot, and at one point, it looked like the market might turn in advance of typical entry signals. However, by Friday, the market and our signal ultimately aligned, resulting in a more standard entry signal. Interestingly, our three tracked indices closed the week within just a few dollars of the projections published last Friday, reinforcing confidence in the model’s validity.

Currently, the model's outputs are indicating the start of a high-probability entry window. As shown in the table and charts below, there’s an 85.7% probability of a positive return over the next 14-day period. It’s worth noting that there could still be some downward movement as this window begins. Additionally, with the U.S. presidential election on Tuesday—one of the year’s most significant events—market dynamics could be particularly responsive. While some analysts on Bloomberg TV mentioned that markets appear to be pricing in a Republican win, it’s important to remember that our model operates independently of news events; it’s designed to focus purely on historical data patterns. Thus, regardless of the election outcome, the current setup suggests the potential for continued market upside in the days and weeks ahead.

Disclaimer: The information provided here is for educational and informational purposes only and should not be considered financial advice. I am not a licensed financial advisor, and my portfolio may not align with your financial goals or risk tolerance. All investments carry risk, including the potential loss of principal. Historical data and model-based projections do not guarantee future performance. Please consult a licensed financial professional before making any investment decisions.

Market Update 10.26.24

This week, we observed an early-week exhaustion pivot that altered our initial forecast from last weekend. Although the final outcomes remained within one standard deviation of our projections, the week’s actual performance diverged from Saturday’s model. In hindsight, a mid-week model update would have better reflected this pivot.

Recently, we’ve noticed a shift in the signal’s pattern, with an increased frequency of entry and exhaustion points, alongside shorter duration windows. This pattern shift brings both advantages and challenges: while it may present more opportunities for high-probability entries, the shorter windows may also reflect reduced market conviction. Trading volumes for major ETFs we track appear slightly lower than in previous months, which could be attributed to traders awaiting more clarity on economic policy with the election approaching.

Looking to next week, the signal currently indicates a potential mid-week pivot toward a high-probability bullish entry for a medium-term position. At the current rate of change, this pivot may occur within a couple of trading days. We may also see some correction in the Nasdaq 100, following patterns observed in other indices.

Once the pivot occurs, I will publish an updated model reflecting the anticipated directional shift. For now, I’ve highlighted the 7-day forecast lines below, as they are the most relevant at this stage.

Disclaimer: The information provided here is for educational and informational purposes only and should not be construed as financial advice. I am not a licensed financial advisor, and my portfolio may not align with your financial goals or risk tolerance. All investments involve risk, including potential principal loss. Historical data and model-based projections do not guarantee future performance. Please consult a licensed financial professional before making any investment decisions.

Market Alert.. Exhaustion Reached

Our signal started showing signs of early exhaustion last week, and this week it has confirmed medium term equity market exhaustion. More to follow in our weekend update.

Market update 10.19.24

This week’s market performance closely aligned with our model’s projections, which were published last weekend. DIA closed at 432.64 compared to our projected 433.47. SPY finished the week at 584.59, slightly below the projection of 584.79. Lastly, QQQ ended at 497.47, just under the expected 500.25. Overall, the model continues to show strong accuracy.

Based on the projected outcomes shown in the table and charts below, the data suggests that the bullish trend may continue. However, we are seeing early signs of exhaustion in the underlying signal. Large gains in the coming days and weeks seem unlikely. Instead, we anticipate a steady, gradual movement higher with fluctuations along the way. Should there be any significant changes in the signal’s direction or quality, we will issue an alert.

Disclaimer: The information presented here is for educational and informational purposes only and should not be construed as financial advice. I am not a licensed financial advisor, and my portfolio may not align with your financial goals or risk tolerance. All investments carry risks, including the potential loss of principal. Historical data and model-based projections are not guarantees of future performance. Always consult a licensed financial professional before making any investment decisions.

Market Pivot in Progress 10.12.24

This week’s market performance aligned with our expectations, with a couple of down days that helped generate our entry signal. I noted this signal on Instagram (@RedOakQuant) on October 9th, which marked the beginning of a high-probability entry window. Typically, our windows last several trading days, but this one seems to be closing quickly, and Monday is likely the final day.

Please note that while the maximum return window may have passed, there may still be opportunities for profitable trades. However, the data indicates that the potential for maximum gains has diminished. Based on historical performance models (as detailed in the table below), the data suggests there could be further upward momentum in the market over the coming weeks. Historically, we’ve seen a pattern of several strong days with 1% or greater gains, followed by a period of slower growth until the market reaches exhaustion.

It’s important to recognize that these insights are based on historical trends and models, which do not guarantee future performance. While the data suggests a higher probability of continued market gains, outcomes can always deviate from the expected pattern. Markets can reverse or experience volatility, even after favorable entry signals, although such a reversal does not appear likely in this specific situation.

Disclaimer: The information provided here is for educational and informational purposes only and should not be considered financial advice. I am not a licensed financial advisor, and my portfolio may not be appropriate for your financial goals or risk tolerance. All investments involve risk, including the potential loss of principal. Historical data and market models are not indicative of future results. Please consult with a licensed financial professional before making any investment decisions.

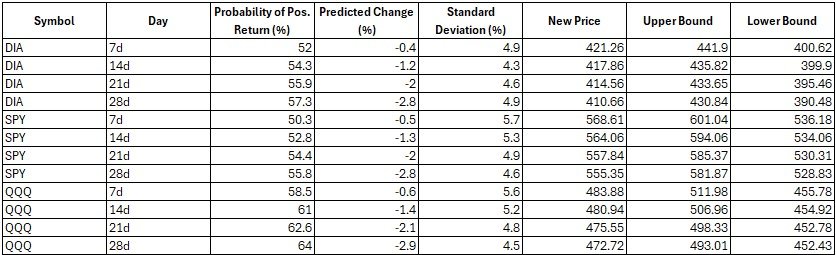

Pivot point incoming! Market update 10.5.24

Our model continues to perform well on the 7-day forecast. DIA closed the week at 423.41, nearly spot on with our predicted value of 421.26. SPY ended at 572.98, compared to a forecast of 568.61, while QQQ finished at 487.32, slightly ahead of the projected 483.88. All three were well within one-eighth of a standard deviation, demonstrating the accuracy of our model.

Looking ahead to next week... subscribe to continue reading!

Our model continues to perform well on the 7-day forecast. DIA closed the week at 423.41, nearly spot on with our predicted value of 421.26. SPY ended at 572.98, compared to a forecast of 568.61, while QQQ finished at 487.32, slightly ahead of the projected 483.88. All three were well within one-eighth of a standard deviation, demonstrating the accuracy of our model.

Looking ahead to next week, we're seeing a potential pivot point in the market. The probability of positive returns is increasing, especially beyond the 14-day outlook. However, our key underlying signal, which drives the model, suggests there may need to be one or two significant down days to align all the components for a strong bullish pivot. As a result, we anticipate some volatility during the week. If this volatility materializes, it will likely be followed by a robust recovery, presenting an ideal opportunity for a pivot point signal.

Market update 9.30.24

Market action this week aligned closely with our model's predictions, which we published on September 21, 2024. DIA ended the week at 422.95, compared to our forecast of 422.4. SPY closed at 571.47, slightly above the predicted 568.36, and QQQ finished at 486.77, just beyond of our projection of 483.41. All these results fell within less than a quarter of a standard deviation, reinforcing our confidence in the accuracy of the model's outputs.

Looking ahead to the coming trading week..... (subscribe to continue reading!)

Market action this week aligned closely with our model's predictions, which we published on September 21, 2024. DIA ended the week at 422.95, compared to our forecast of 422.4. SPY closed at 571.47, slightly above the predicted 568.36, and QQQ finished at 486.77, just beyond of our projection of 483.41. All these results fell within less than a quarter of a standard deviation, reinforcing our confidence in the accuracy of the model's outputs.

Looking ahead to the coming trading week, the model shows signs of weakness and caution. How the market performs will largely depend on whether it can recover quickly early in the week. If not, there are notable causes for concern. The outputs below reflect these potential risks, and in response, we have significantly de-risked our portfolio to safeguard accumulated gains.

Market Update 9.21.24

This week’s market action was marked by a notable event: the FOMC rate cut of 50 basis points. We published a mid-week update shortly before the announcement, explaining that we saw a 50/50 chance of gains versus losses. In response, we reduced our leveraged positions prior to the meeting while keeping our unleveraged index ETFs in place. This strategy minimized our risk exposure while still allowing us to benefit from potential market upside.

Despite the significant news, the model was spot-on with its weekly prediction, which was published last week. DIA was projected to end the week at 420.33, and the actual close on Friday was 420.57. SPY was projected to close at 568.75, with an actual close of 568.25. QQQ was projected to finish at 482.48, and the actual close was 482.44. These results are impressive.

Looking ahead to next week, the AI-derived model predicts...

This week’s market action was marked by a notable event: the FOMC rate cut of 50 basis points. We published a mid-week update shortly before the announcement, explaining that we saw a 50/50 chance of gains versus losses. In response, we reduced our leveraged positions prior to the meeting while keeping our unleveraged index ETFs in place. This strategy minimized our risk exposure while still allowing us to benefit from potential market upside.

Despite the significant news, the model was spot-on with its weekly prediction, which was published last week. DIA was projected to end the week at 420.33, and the actual close on Friday was 420.57. SPY was projected to close at 568.75, with an actual close of 568.25. QQQ was projected to finish at 482.48, and the actual close was 482.44. These results are impressive.

Looking ahead to next week, the AI-derived model predicts a relatively flat week-over-week change, with DIA expected to change by 0.2%, SPY by 0%, and QQQ by -0.2%. Notably, the probability of positive returns remains significantly high across all periods. Based on our interpretation, we believe the market may experience a slight "float up" in the coming weeks. While this doesn’t meet the criteria for one of our entry windows, we plan to participate using non-leveraged instruments.

Pre-FED Market Update

This is an out-of-cycle update, but given the situation it is warranted. Today the FED will announce their plans for interest rate changes. Our models are showing an elevated risk of downside moves. As reported on Bloomberg this morning, the market is pricing in a 50% chance of a 50 basis point reduction. This gives us concern, because if they deliver a 25 basis point reduction (which is widely believed to be the practical solution) there could be a negative market reaction. Therefore, we have removed our leveraged positions. Our non-leveraged index positions are still in-place.

Market update 9.14.24

This week’s market movements were unusually fast compared to our traditional entry cycles. In last week's post, we anticipated sideways or choppy trading as the market prepared for the next bullish wave, which we expected to coincide with the FOMC rate cut next week. However, the market swiftly moved through the consolidation phase, with SPY up 4% week-over-week and QQQ nearly 6%.

Our model's signals triggered....

This week’s market movements were unusually fast compared to our traditional entry cycles. In last week's post, we anticipated sideways or choppy trading as the market prepared for the next bullish wave, which we expected to coincide with the FOMC rate cut next week. However, the market swiftly moved through the consolidation phase, with SPY up 4% week-over-week and QQQ nearly 6%.

Our model's signals triggered an entry window on Thursday, which closed quickly by Friday—an uncommon occurrence. This rapid shift raises concerns that an underlying factor could trigger a quick sell-off.

As of Friday's close, our model indicates a moderate pace of bullish movement in the coming week. We will monitor the situation closely and set tight stops on our leveraged positions.

Market update 9.7.24

This week’s market activity trended notably downward, as we anticipated in last week’s update. Price movements for SPY and DIA aligned with our model’s projected one standard deviation variance. While QQQ slightly exceeded this range, it’s not entirely unexpected, as a one standard deviation move is expected around 68% of the time in a normal distribution. Many television commentators seemed puzzled by the Tuesday sell-off, citing a lack of clear catalysts. However, having tracked our indicators for over a decade, we know that this kind of movement often occurs without an obvious trigger. That’s the advantage of our model—we frequently spot potential market shifts that others miss. While no forecast is flawless, our predictions are typically quite close.

Interestingly, the market has quickly recalibrated after this recent downturn. Our indicators are...

This week’s market activity trended notably downward, as we anticipated in last week’s update. Price movements for SPY and DIA aligned with our model’s projected one standard deviation variance. While QQQ slightly exceeded this range, it’s not entirely unexpected, as a one standard deviation move is expected around 68% of the time in a normal distribution. Many television commentators seemed puzzled by the Tuesday sell-off, citing a lack of clear catalysts. However, having tracked our indicators for over a decade, we know that this kind of movement often occurs without an obvious trigger. That’s the advantage of our model—we frequently spot potential market shifts that others miss. While no forecast is flawless, our predictions are typically quite close.

Interestingly, the market has quickly recalibrated after this recent downturn. Our indicators are nearing signals of a bullish turn, although they haven’t fully aligned just yet. We anticipate a significant bullish move, likely to coincide with the upcoming September FED meeting. Whether the rate cut is 25 or 50 basis points, it seems poised to be met with strong enthusiasm. We will continue to monitor our indicators closely to see if this scenario continues to unfold as expected.

As we look ahead to next week, we expect further downside pressure or potentially choppy trading as the market works through the final stages of this pullback.

In the table above, our model's predicted change indicates a slightly negative bias for all three indexes over the next seven days.

The whisker plot above shows an improving trend as we look out 14 days or more into the future.

The bar chart above shows a significant improvement in the probability of positive return after the 14-day mark. We think this is aligned with the FOMC rate cut decision planned for mid-September.

Market Update 8.30.24

Once again, our 7-day predictions were remarkably accurate, staying within a quarter of a standard deviation across all three major indices we track. As anticipated, the markets remained generally flat over this period.

Looking ahead to next week, we foresee a similar trend. While there may be a slight upward bias, the probability of a significant upward move is low. Additionally, there is considerable downside risk if traders react negatively to unfavorable news. Although this outlook aligns with the recent medium-term market rally, it reinforces our view that portfolio managers should consider maintaining neutral risk positions in the coming week.

Our model's outputs closely mirror last week's results, driven by the consistent market conditions that serve as our inputs. The price targets have been updated to reflect the latest closing prices as of August 30, 2024.

The whisker chart above highlights significant standard deviations, reflecting a considerable level of historical market indecision under similar conditions dating back to 2012.

The bar chart above illustrates the probability of positive returns over time. The model's nominal probability of positive return is 63%, so when observed probabilities fall below this threshold, it signals historically significant downside risk in the market.

Market Update 8.24.24

This week’s market action aligned with our projections published last weekend. Our projected values for DIA, SPY, and QQQ were almost spot-on for end-of-week prices on all three indexes.

Sign up to view our forecast for next week!

This week’s market performance closely mirrored our projections from last weekend. The predicted end-of-week prices for the DIA, SPY, and QQQ were remarkably accurate, reflecting the precision of our forecasting models.

As we look ahead, the market appears to be approaching a medium-term exhaustion point. Our model indicates a significant decline in the probability of positive returns, now falling below our nominal threshold of 63%. For the DIA, the probability of a positive return is a mere 45%, accompanied by 7-day predicted changes that come with wide standard deviations, extending into negative territory. Investors holding leveraged bullish positions should proceed with caution, as the market’s current dynamics suggest increased risk.

Model outputs as of market close on 8.23.24.

The chart above displays the predicted changes in selected market indexes, with whiskers representing one standard deviation. Notably, the 7-day standard deviations extend significantly into negative territory, suggesting that any "bad news" could trigger substantial market pullbacks next week. On the other hand, there's also a considerable potential for gains, as the upper whiskers indicate possible extensions into positive territory. As a result, our outlook on the market is neutral at this point—neither bullish nor bearish.

The bar chart above illustrates the probability of positive returns across different time horizons. Our model sets the nominal probability of positive returns at 63%. The probabilities shown in the chart fall significantly below this average, signaling an exhausted medium-term bullish market.