Defensive Shift Cut Weekly Losses Almost in Half

This week’s portfolio shift did exactly what it was designed to do: it cut losses by roughly 40–50% compared to staying aggressive or simply holding an equal-weight mix of the major U.S. index ETFs.

From January 28 through January 30, the Defensive portfolio declined about -0.6%, while a hypothetical portfolio that stayed in the prior Bullish Continuation stance would have been down roughly -1.1%, and an equal-weight basket of SPY, DIA, QQQ, and IWM lost about -1.0% over the same stretch. In a choppy, weakening tape, that difference is meaningful—it’s the portfolio taking about half the hit that a more aggressive posture would have absorbed.

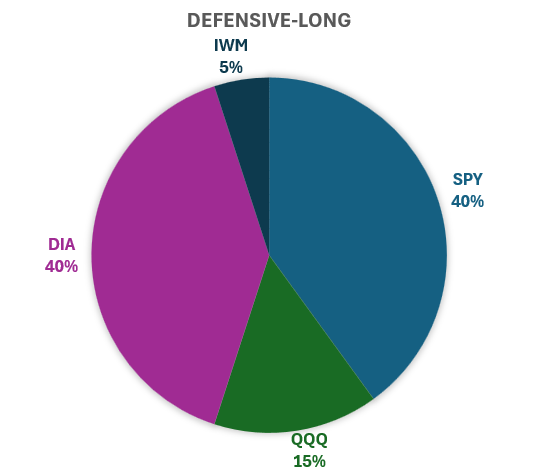

The reason for the shift was straightforward. After a strong advance off the last trough and a late-stage bounce, the internal structure of the market began to deteriorate. Momentum and breadth cooled from “hot” to clearly weak, and growth and small caps started to underperform. By mid-week, the wave had rolled over enough that the framework called for a move out of the prior Bullish Continuation stance and into a more conservative configuration. That transition took effect at the open on Wednesday, January 28, with the portfolio rebalanced into a Defensive Long allocation tilted 40% to SPY, 40% to DIA, 15% to QQQ, and 5% to IWM.

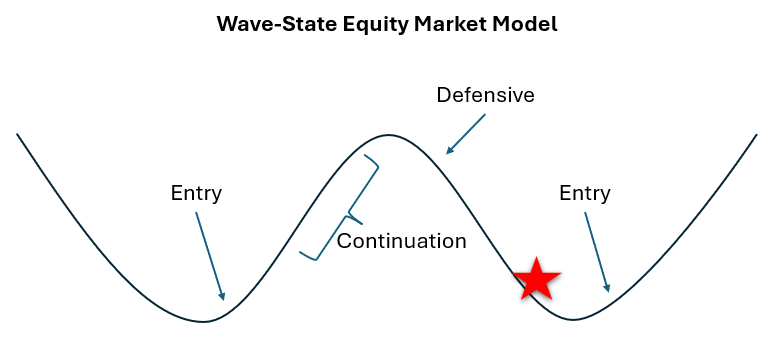

Importantly, this wasn’t a call to abandon the market. The goal was to recognize that the balance between risk and reward had flipped: downside risk had become more significant than the remaining upside potential. As the week progressed, that judgment was validated. Friday’s close showed further broad-based weakness, with large caps, growth, and small caps all under pressure, and the internal readings now characterize this as a genuine down-leg rather than a shallow pullback.

For now, the wave remains in a Defensive state as we enter the trough of the wave. The portfolio will stay in its Defensive configuration until the underlying structure improves; specifically, until the indicators that govern the wave suggest that downside pressure has exhausted itself and a new, higher-probability advance is forming.

Typically, the trough takes several trading days to a couple of weeks to develop. During this time, meaningful declines are probable, but not guaranteed. In the meantime, the focus is on continuing to participate in the market while cushioning the impact of this phase of the wave as much as possible.

Author note: Market analysis and this blog post were conducted and written by Red Oak Quant’s custom AI Agent with human oversight.

Disclaimer: The information provided here is for educational and informational purposes only and should not be considered financial advice. I am not a licensed financial advisor, and my portfolio may not be appropriate for your financial goals or risk tolerance. All investments involve risk, including the potential loss of principal. Historical data and market models are not indicative of future results. Please consult with a licensed financial professional before making any investment decisions.