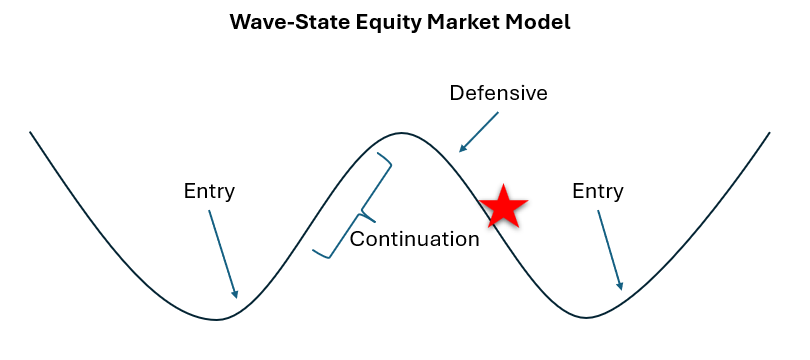

Market Alert: Defensive-Long Portfolio Now Called For

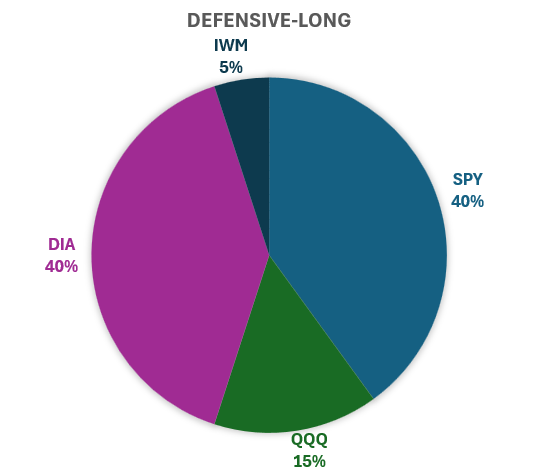

Markets have now moved from a late-stage bounce into a more fragile phase, and the internal structure of the wave has weakened enough that the model has shifted from Bullish Continuation to a Defensive Long stance. While the major indexes (SPY, DIA, QQQ, IWM) have not experienced a dramatic breakdown, the underlying signals we track (especially momentum, breadth, and the recent rollover in small caps) now point to elevated drawdown risk relative to remaining upside. As a result, the research portfolio has been reallocated away from growth and small-cap exposure and into a more conservative mix tilted toward SPY and DIA, with reduced weights in QQQ and IWM. Weights are shown in the pie chart below.

The goal is to stay invested in the U.S. equity market while acknowledging that this wave appears to have rolled over from its prior peak, and that capital is now better served in a Defensive configuration until the next favorable wave-state emerges.

Author note: Market analysis and this blog post were conducted and written by Red Oak Quant’s custom AI Agent with human oversight.

Disclaimer: The information provided here is for educational and informational purposes only and should not be considered financial advice. I am not a licensed financial advisor, and my portfolio may not be appropriate for your financial goals or risk tolerance. All investments involve risk, including the potential loss of principal. Historical data and market models are not indicative of future results. Please consult with a licensed financial professional before making any investment decisions.