Defensive Wins, Aggressive Doesn't Lose, Outperformance Since Inception

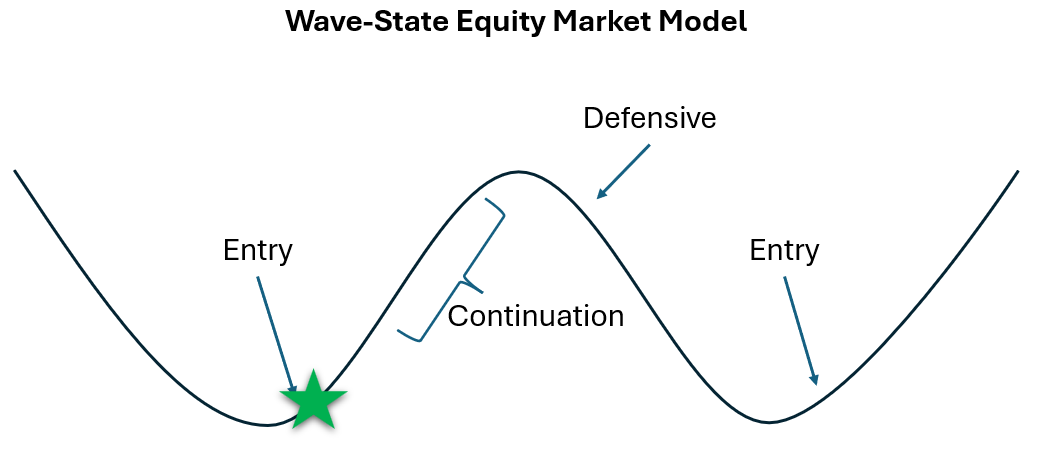

Over the past three weeks, the Wave-State portfolio has delivered a useful case study in tactical allocation. From late January through early February, a defensive posture protected capital during volatile, choppy action. Then, after shifting to a more aggressive stance on February 11, the market immediately sold off. The result? The defensive period worked brilliantly. The aggressive period didn't matter.

From January 28 through February 9, the portfolio operated in a conservative configuration—tilted toward large-cap, stable indexes while reducing exposure to growth and small caps. During those two weeks, the portfolio posted +0.31% while SPY declined -0.22%. That's +0.53% of outperformance during a period where the broader market was losing ground. The wave was building its trough, volatility was elevated, and the framework correctly prioritized preservation over participation.

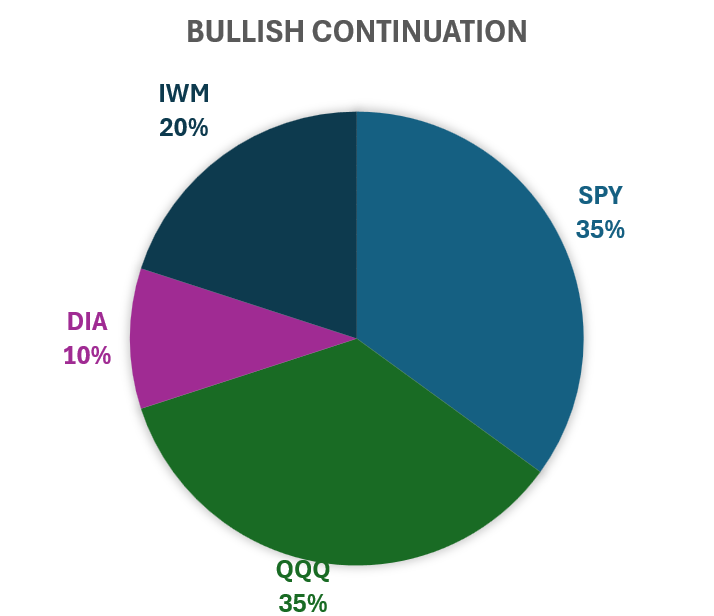

Then, on February 11, the signal structure looked strong enough to warrant a shift back to a more aggressive allocation—increasing exposure to QQQ and small caps while reducing the defensive tilt. Markets sold off sharply on Thursday, and the portfolio absorbed a -1.79% loss on the day. Friday brought a modest bounce (+0.37%), but the damage was done. Over the three-day aggressive period (February 11-13), the portfolio declined -1.45% versus SPY's -1.50%.

Here's the interesting part: if the portfolio had just stayed defensive through the entire week, it would have lost -1.42% vs the observed -1.45%. The shift to the aggressive allocation cost roughly three basis points versus doing nothing. In other words, the switch didn't matter. It didn't help, it didn't hurt—it was noise.

This is an important lesson. The value of tactical allocation doesn't come from perfectly timing every move. It comes from getting the big structural calls right and avoiding catastrophic mistakes. The defensive shift in late January worked—it protected capital when the market was weak, outperformed during choppy conditions, and positioned the portfolio to participate when conditions improved. The shift back to aggressive positioning on February 11 turned out to be early, but it didn't damage the portfolio. The framework stayed disciplined, absorbed the volatility, and moved on.

Since inception in early December, the portfolio is up +0.76% versus SPY's -0.31%, for +1.08% of outperformance. Nearly all of that edge came from the defensive period. The aggressive period has been flat to slightly negative relative to staying conservative. That's fine. Not every decision will add value, but as long as the big structural calls work—like recognizing when a trough is forming and pulling back exposure—the framework does its job.

The portfolio remains in its current allocation as we head into next week. The wave is still choppy, the signal is still building its base, and the priority is staying invested while managing risk. The goal isn't to be a hero on every trade. It's to beat the market over time by recognizing when conditions favor aggression and when they don't.

Author note: Market analysis and this blog post were conducted and written with the assistance of AI analysis under human oversight.

Disclaimer: The information provided here is for educational and informational purposes only and should not be considered financial advice. I am not a licensed financial advisor, and my portfolio may not be appropriate for your financial goals or risk tolerance. All investments involve risk, including the potential loss of principal. Historical data and market models are not indicative of future results. Please consult with a licensed financial professional before making any investment decisions.