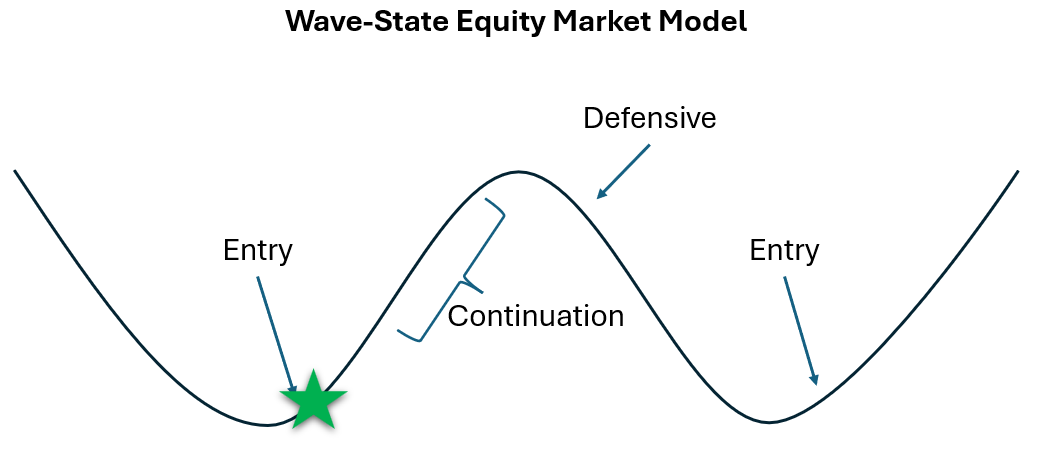

Market Alert: Research Portfolio Switches to Bullish-Continuation

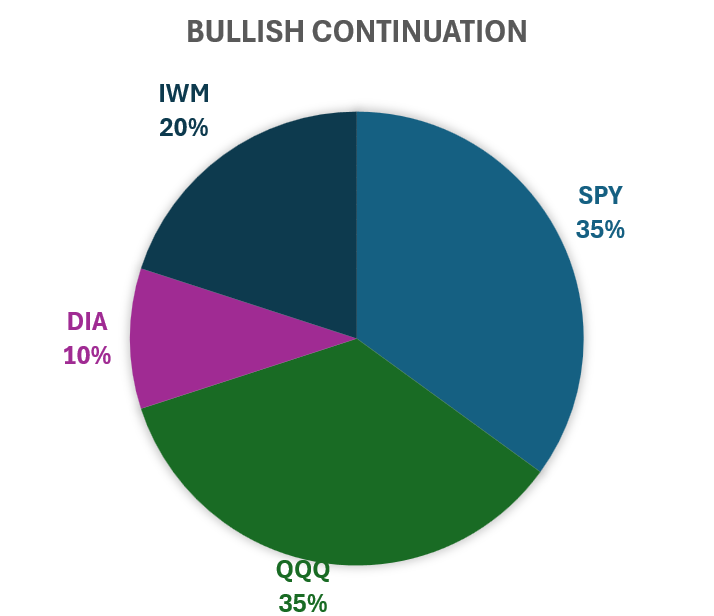

Effective at the open on February 11, the portfolio will shift from a Defensive posture into a Bullish Continuation configuration, reflecting evidence from our internal wave-state framework that a new up-leg is forming after the recent down-wave and flush. This change increases exposure to growth and small caps, moving to 35% SPY, 10% DIA, 35% QQQ, and 20% IWM, with no leverage, cash, or volatility positions. In short, the goal of this adjustment is to move from “cushioning downside” back toward “participating more fully in upside” now that breadth, momentum, and volatility have collectively transitioned from stress conditions into a more constructive regime.

Author note: Market analysis and this blog post were conducted and written by Red Oak Quant’s custom AI Agent with human oversight.

Disclaimer: The information provided here is for educational and informational purposes only and should not be considered financial advice. I am not a licensed financial advisor, and my portfolio may not be appropriate for your financial goals or risk tolerance. All investments involve risk, including the potential loss of principal. Historical data and market models are not indicative of future results. Please consult with a licensed financial professional before making any investment decisions.