Markets Pull Off A Late Stage Bounce, But Vulnerability Remains

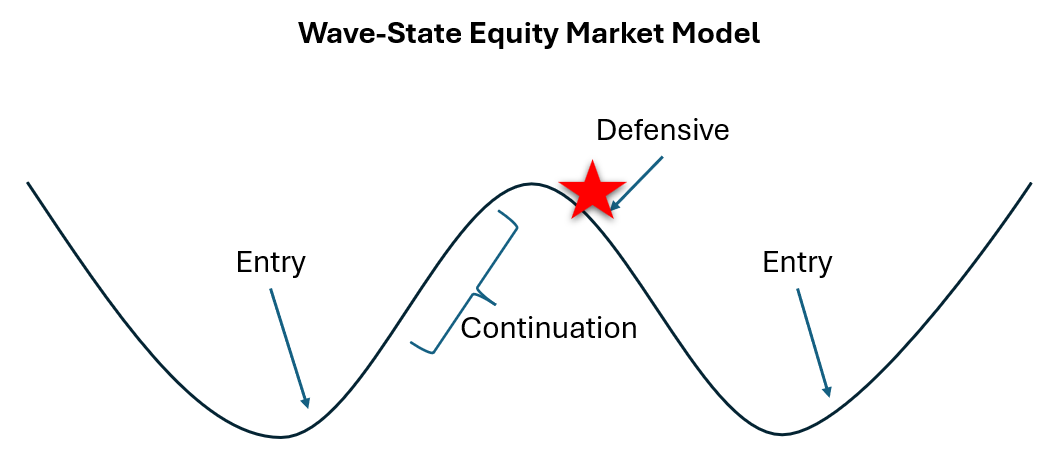

Over the past couple weeks, the U.S. equity market has followed a fairly textbook pattern for a mature wave. After a strong advance off the prior trough, internal measures of breadth and momentum pushed into “hot” territory, especially in the small-cap space. That’s typically where the structure becomes more vulnerable to a drawdown, and we finally saw that vulnerability show up in price last week.

Following those peak conditions, the market experienced a sharp pullback, with all four major indexes (SPY, DIA, QQQ, and IWM) moving lower and volatility briefly moving higher. From the perspective of the wave, this looked less like a surprise event and more like the natural cooling that tends to follow an extended, overbought phase.

Since then, we’ve seen a bounce from that decline. Large-cap indexes like SPY, DIA, and QQQ have recovered a meaningful portion of the drop and, on the surface, still look reasonably strong. However, Friday’s trading session revealed an important nuance: small caps showed notable relative weakness. While the large-cap benchmarks held up, IWM lagged and struggled to participate in the rebound to the same extent. Historically, that type of divergence can serve as an early warning. When small caps begin to underperform after leading earlier in the wave, it often signals that risk appetite is fading and that the wave may be transitioning from “strong and extended” toward a more fragile, late-stage phase.

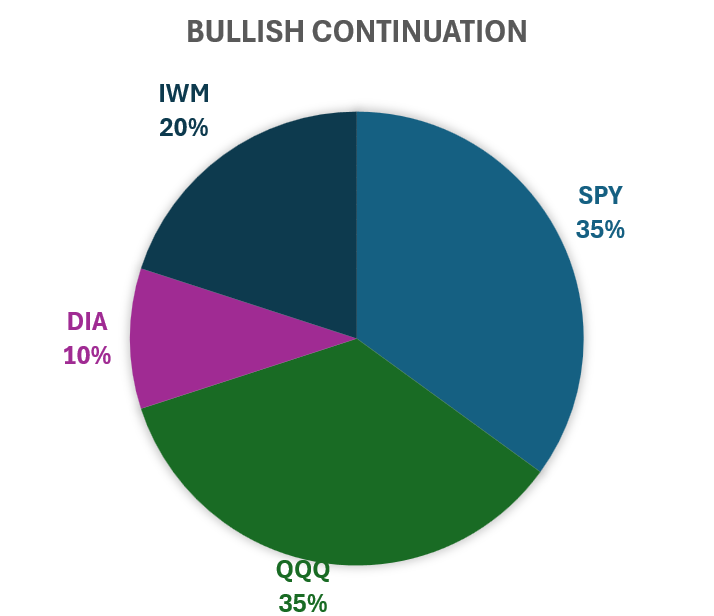

From a portfolio standpoint, this keeps us in a Bullish Continuation stance, but without leverage. The model still views the environment as broadly bullish, and the data do not yet justify a full shift into a Defensive regime. At the same time, the combination of prior overbought conditions, a sharp pullback, a less convincing rebound, and emerging small-cap underperformance argues against increasing risk into this strength. Instead, the focus is on staying fully invested across the major U.S. equity indexes while watching closely to see whether this small-cap weakness remains a brief wobble or develops into a more persistent leadership change that would confirm the wave is rolling over into a more defensive phase.

As always, the goal is not to predict every short-term move, but to keep portfolio construction aligned with where we are in the wave: strong enough to stay invested, but mature enough to treat this environment with caution and respect the early warning signs that are starting to appear under the surface.

Author note: Market analysis and this blog post were conducted and written by Red Oak Quant’s custom AI Agent with human oversight.

Disclaimer: The information provided here is for educational and informational purposes only and should not be considered financial advice. I am not a licensed financial advisor, and my portfolio may not be appropriate for your financial goals or risk tolerance. All investments involve risk, including the potential loss of principal. Historical data and market models are not indicative of future results. Please consult with a licensed financial professional before making any investment decisions.