Markets Rally As Expected; Bullish Continuation Portfolio Remains

In last week’s blog post, I noted that the markets appeared ready to exit the trough of the wave. That is exactly what played out. The broad indexes – SPY, DIA, QQQ, and IWM – all posted positive performance for the week, with IWM leading the pack and rising approximately 4.92%. That kind of small-cap leadership is very typical of this phase of the wave.

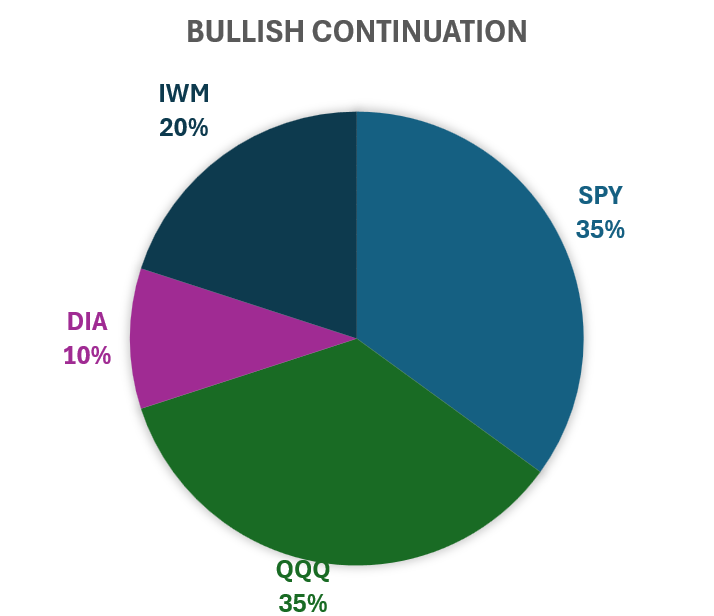

During the initial rise out of a trough, capital often rotates into higher-beta, riskier assets first. In practice, that usually shows up as small caps (IWM) outperforming the large-cap benchmarks (SPY and DIA) and even the mega-cap growth names in QQQ. This is why the Bullish Continuation portfolio is constructed with a meaningful small-cap allocation: the structure of the wave tends to reward that tilt during the early and middle portions of an up-leg.

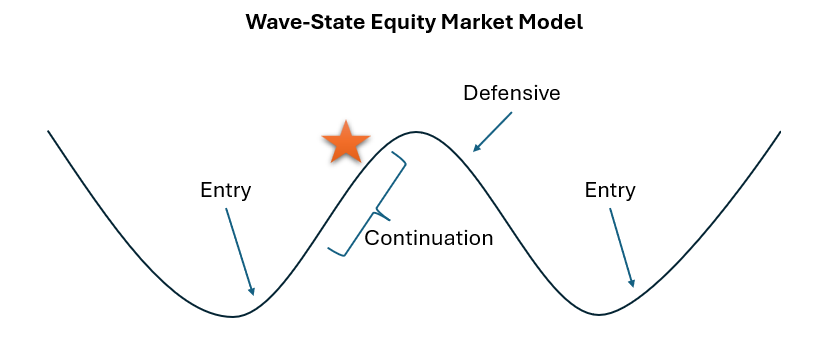

However, that same behavior can also serve as an early warning when the wave matures. As the structure approaches the top of the peak, it is common to see those same riskier assets roll over first. Small caps begin to underperform, breadth narrows, and the price action in IWM becomes a kind of “canary in the coal mine” for the rest of the indexes. When that pattern shows up in conjunction with a weakening Signal, it often marks the transition from Bullish Continuation back toward a more Defensive posture.

Right now, based on the latest readings from the Signal and the supporting indicators, the wave is toward the top of the peak but not necessarily at the top (illustrated below with the star indicating the approximate wave status.) Momentum remains constructive, breadth is still supportive, and there are no clear signs yet of the kind of deterioration that would justify shifting back to a Defensive allocation. At the same time, short-term oscillators are stretched enough that it would be premature to add leverage simply because the market has been moving in our favor.

For that reason, the portfolio remains positioned in the Bullish Continuation configuration: fully invested across SPY, DIA, QQQ, and IWM, with a deliberate tilt toward small caps, but without leverage. This aligns with the backtested rule set: stay long and allow the wave to play out, but reserve leverage for those more selective periods where the Signal, momentum, and risk conditions line up in a historically higher-probability window.

As we move forward, I will be watching closely for two things: (1) whether small-cap leadership persists or starts to fade, and (2) whether the Signal begins to roll over from the upper band or consolidates in a healthy way. Either outcome will guide the next adjustment to the portfolio – whether that’s eventually tightening back toward Defensive, or, if conditions remain favorable and reset properly, considering a future leverage window. For now, the evidence continues to support Bullish Continuation.

Author note: Market analysis and this blog post were conducted and written by Red Oak Quant’s custom AI Agent with human oversight.

Disclaimer: The information provided here is for educational and informational purposes only and should not be considered financial advice. I am not a licensed financial advisor, and my portfolio may not be appropriate for your financial goals or risk tolerance. All investments involve risk, including the potential loss of principal. Historical data and market models are not indicative of future results. Please consult with a licensed financial professional before making any investment decisions.