Strong Wave, Strong Small Caps; Market Now Vulnerable at the Top of the Cycle

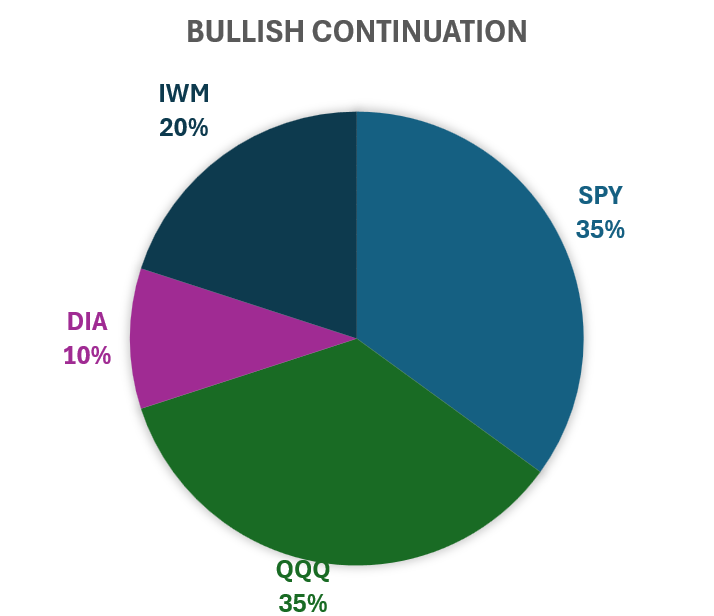

Over the past few weeks, the U.S. equity market has delivered exactly the type of behavior we expect when the wave moves from a trough into a strong advancing phase. The internal structure has been consistently supportive, and price action has followed through. All four of the primary equity benchmarks we track, SPY, DIA, QQQ, and IWM, have participated in the advance, but once again, small caps have stood out.

IWM (the small-cap index) has shown notable strength in this wave. Coming off the trough, capital tends to rotate toward higher-beta, risk-sensitive segments of the market. That usually shows up as small caps outperforming the larger, more stable names that dominate SPY and DIA. We have seen that pattern clearly during this up-leg, and it has validated the design of the Bullish Continuation portfolio, which maintains a deliberate small-cap allocation specifically to capture this phase of the cycle.

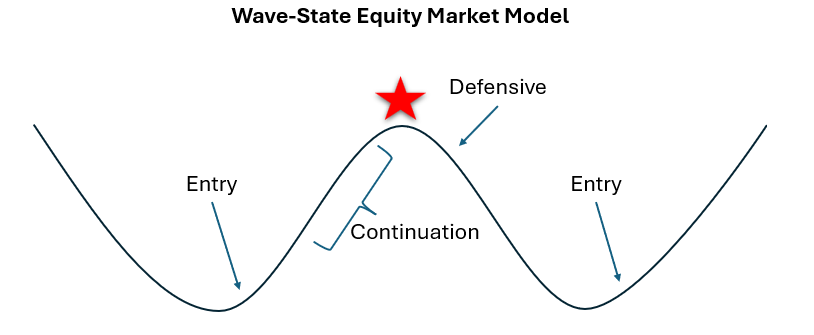

At the same time, the current readings from the underlying structure suggest that the broad U.S. equity market is now near a probable top of the wave. Internal measures of breadth, momentum, and short-term oscillators are all in “hot” territory, consistent with a strong, extended advance rather than an early-stage rally. Historically, this combination has often preceded some form of cooling period, whether that takes the form of a shallow, sideways consolidation or a sharper, more traditional drawdown.

Importantly, this does not imply that a major top is in place or that the longer-term trend has reversed. What it does suggest is that the risk/reward balance has shifted. The market has already absorbed a substantial portion of the upside that typically emerges from a trough, and the probability of a near-term shakeout or pullback is higher than it was a few weeks ago. In this context, the same small-cap segment that led the rally can now serve as an early warning indicator: if the wave is maturing, small caps often begin to roll over and underperform before the larger indexes follow.

Given this backdrop, the portfolio remains in a Bullish Continuation configuration without leverage. The model still treats the environment as structurally bullish, and the data do not yet justify a shift back to a Defensive posture (although it wouldn’t take much to cause the portfolio rules to call for a change). At the same time, the extension of the current wave argues against increasing risk into strength. Instead, the focus is on:

Continuing to participate in the trend with a diversified mix across SPY, DIA, QQQ, and IWM.

Monitoring small-cap behavior and internal market structure for signs that the wave has transitioned from “strong and extended” into “topping and weakening.”

Being prepared to adjust the portfolio if the data confirm that the current wave has fully run its course.

For now, the message from the structure is straightforward: this has been a strong wave with strong small caps, and the market is likely operating near the top of the current short-term cycle, where it is more vulnerable to a drawdown of some kind than it was earlier in the advance. How that vulnerability resolves, through a mild consolidation or a sharper correction, will depend on how the structure evolves from here, and the portfolio will adapt as the data dictates.

Author note: Market analysis and this blog post were conducted and written by Red Oak Quant’s custom AI Agent with human oversight.

Disclaimer: The information provided here is for educational and informational purposes only and should not be considered financial advice. I am not a licensed financial advisor, and my portfolio may not be appropriate for your financial goals or risk tolerance. All investments involve risk, including the potential loss of principal. Historical data and market models are not indicative of future results. Please consult with a licensed financial professional before making any investment decisions.