Wave-State Shift: From Defensive to Bullish

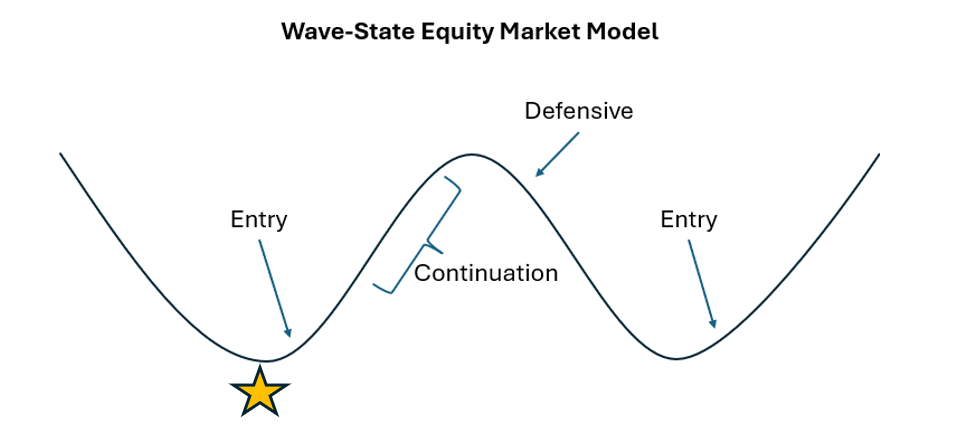

This week, our momentum and breadth indicators continued sliding down the current wave and have now reached what appears to be a probable trough (marked with a star in the chart below). The exact length of a trough is never perfectly predictable, but historically it tends to persist for roughly three to five trading days.

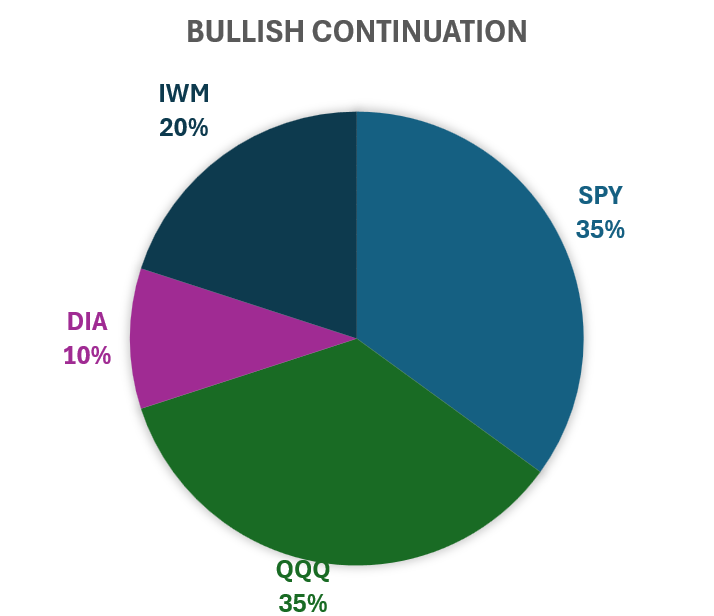

Given today’s structure, our rule matrix calls for a portfolio shift from Defensive-Long to Bullish-Continuation (without leverage). In this regime, the portfolio tilts more heavily toward SPY and QQQ, which have typically exhibited stronger participation during this phase of the wave. I’ve included the regime’s standard index weight proportions for reference.

From here, the key is confirmation that the market is beginning to move out of the trough. If that occurs, we may eventually see conditions that justify tactical leverage. For that to be on the table, we would generally need to observe a volatility event, specifically a VIX spike followed by a quick collapse, while the indicators remain in the trough zone. At the moment, this wave does not appear to be setting up for that pattern, but we will continue monitoring closely.

Author note: Portions of this market analysis were conducted by Red Oak Quant’s custom AI Agent.

Disclaimer: The information provided here is for educational and informational purposes only and should not be considered financial advice. I am not a licensed financial advisor, and my portfolio may not be appropriate for your financial goals or risk tolerance. All investments involve risk, including the potential loss of principal. Historical data and market models are not indicative of future results. Please consult with a licensed financial professional before making any investment decisions.