Wave-State Equity Model Proves Worthy, Remains Defensive-Long

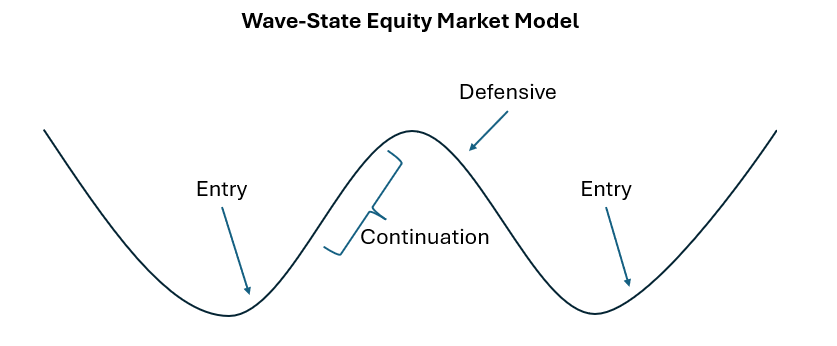

Last week I introduced the Wave-State Equity Market Model, and I appreciate the thoughtful feedback many of you shared.

One point of clarification is worth emphasizing: the portfolio is an “always-long” portfolio. We are always invested in the market. The reasoning is straightforward—precise market timing is extremely difficult, and holding cash for extended periods can result in missing substantial gains. Rather than attempting to sidestep every drawdown, the model is designed to remain invested while adjusting risk exposure based on prevailing market structure.

The objective is simple in concept, though difficult in execution: outperform the broader market over time. This is pursued by remaining long equities, dynamically adjusting allocations among index ETFs based on the current wave-state, and applying tactical leverage only when historical analogs indicate a high probability of favorable outcomes. In those specific environments—where similar market structures have historically produced positive returns roughly 70–80% of the time—the Wave-State model has proven particularly effective at identifying opportunity windows.

This past week, the Wave-State remained Defensive (but still long). The market had already reached an elevated level of momentum and was beginning to cool when the Federal Reserve announced a significant policy change mid-week. That announcement produced a sharp bullish reaction, but it arrived at a moment when market conditions were already overheated. The resulting push into a “white-hot” state increased downside risk rather than improving forward return asymmetry.

Against that backdrop, the broad sell-off that followed on Friday was not unexpected within the Wave-State framework. While the Federal Reserve’s action is broadly constructive for markets looking ahead into 2026, near-term cooling remains the more probable path. Over the next one to two weeks, further moderation in the Wave-State is likely.

To be clear, this is not a definitive bearish call. It is a recognition of elevated risk. In defensive configurations, the portfolio shifts weight toward more stable index exposures such as SPY and DIA, while reducing exposure to higher-beta areas like QQQ and IWM. Historically, this mix has helped limit drawdowns during periods of market weakness, while still allowing participation should prices continue to drift higher.

The goal remains consistency and discipline—staying invested, respecting risk asymmetry, and allowing market structure, not headlines, to guide positioning.

Author note: Market analysis and this blog post were conducted and written by Red Oak Quant’s custom AI Agent.

Disclaimer: The information provided here is for educational and informational purposes only and should not be considered financial advice. I am not a licensed financial advisor, and my portfolio may not be appropriate for your financial goals or risk tolerance. All investments involve risk, including the potential loss of principal. Historical data and market models are not indicative of future results. Please consult with a licensed financial professional before making any investment decisions.