Wave Structure Improving, Portfolio Positioned for Participation

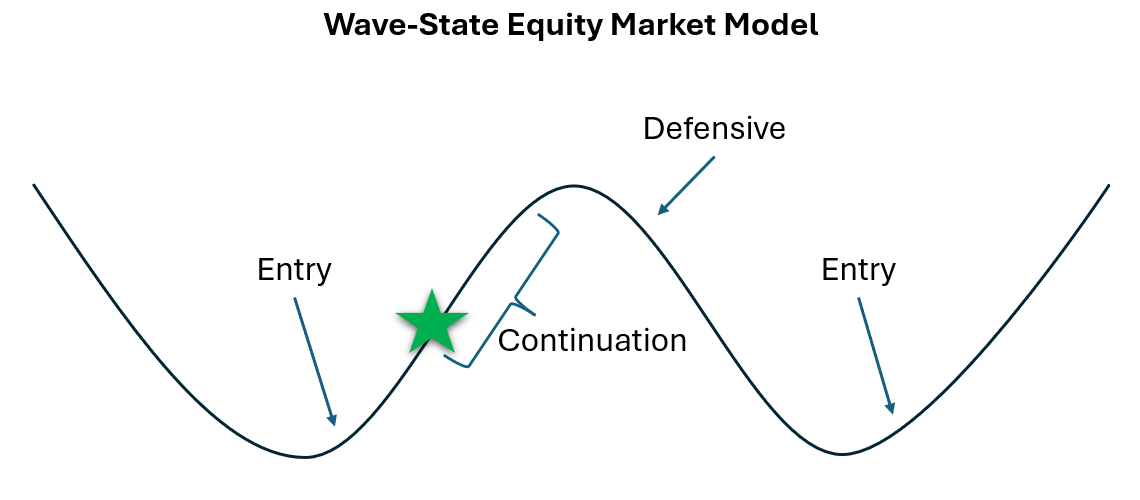

This week delivered what the Wave-State framework has been waiting for: sustained momentum confirming the market is building strength off the trough. After two weeks of choppy action following the shift to a more aggressive allocation, the underlying structure has finally started to cooperate.

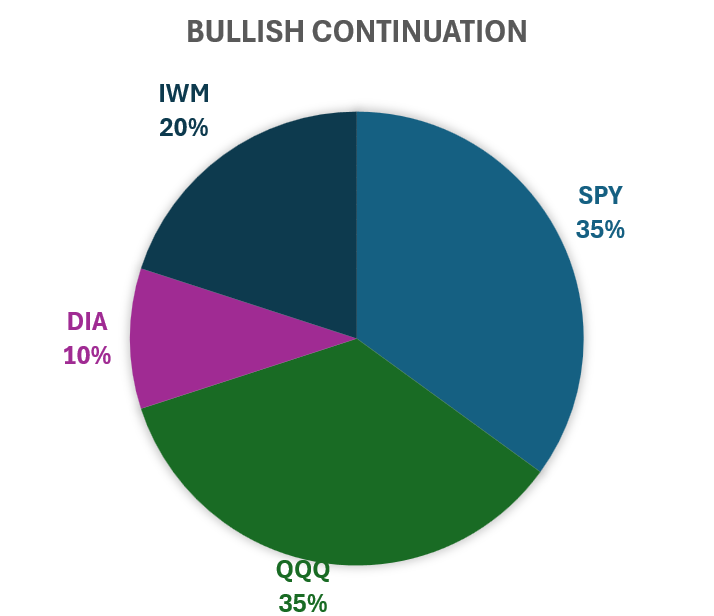

From February 13 through February 20, SPY gained +1.13%. The portfolio gained +0.94% during the week, underperforming SPY by a small margin as the rally was led more by large caps than by the growth and small-cap segments where the aggressive allocation is tilted. The important development isn't the weekly performance, it's the wave structure. After spending most of February testing whether the trough had truly formed, the market has now delivered sustained rising momentum and strengthening participation across indexes. This is what the framework looks for when assessing whether a wave has exited the bottom.

Since shifting to the aggressive allocation on February 11, the portfolio is down -0.52% versus SPY's -0.39%. That modest underperformance reflects the timing of the shift—it came just ahead of a sharp selloff on February 12, followed by consolidation before this week's rally materialized. The framework stayed disciplined through that volatility and is now positioned to participate as the wave builds.

Since its inception in early December, the portfolio is up +1.71% versus SPY's +0.81%, for +0.90% of outperformance. The edge continues to come primarily from the defensive period in late January and early February, which successfully preserved capital during the trough-building phase. The aggressive positioning over the past two weeks has been flat to slightly negative relative to the benchmark, but the structure is improving and the framework remains patient.

The goal isn't perfection—it's alignment. The defensive shift in late January worked because it recognized the wave was rolling over and needed time to build a base. The shift back to aggressive positioning on February 11 was early, but the framework doesn't demand perfect entries. It demands staying invested, managing risk, and positioning the portfolio to capture the next leg when the structure confirms. This week, the structure confirmed.

Author note: Market analysis and this blog post were conducted and written with the assistance of AI analysis under human oversight.

Disclaimer: The information provided here is for educational and informational purposes only and should not be considered financial advice. I am not a licensed financial advisor, and my portfolio may not be appropriate for your financial goals or risk tolerance. All investments involve risk, including the potential loss of principal. Historical data and market models are not indicative of future results. Please consult with a licensed financial professional before making any investment decisions.