Defensive Shift Cut Losses by 96%

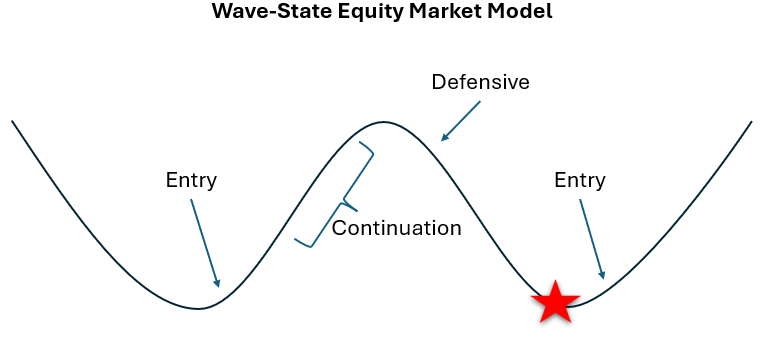

Over the past ten trading days, the Wave-State portfolio did exactly what it was designed to do: it cut losses by roughly 96% compared to staying aggressive.

From January 28 (the date of the Defensive flip) through February 6, the Defensive portfolio posted a return of +0.10%—essentially flat despite significant market chop. Compare that to what happened elsewhere:

SPY declined -0.70%

Equal-weight basket (SPY/DIA/QQQ/IWM) fell -0.45%

Staying in the prior Bullish Continuation stance would have lost -1.18%

The defensive posture protected against 1.28% of additional losses. In a choppy, weakening tape, that difference is meaningful—it's the portfolio taking about 4% of the hit that a more aggressive posture would have absorbed.

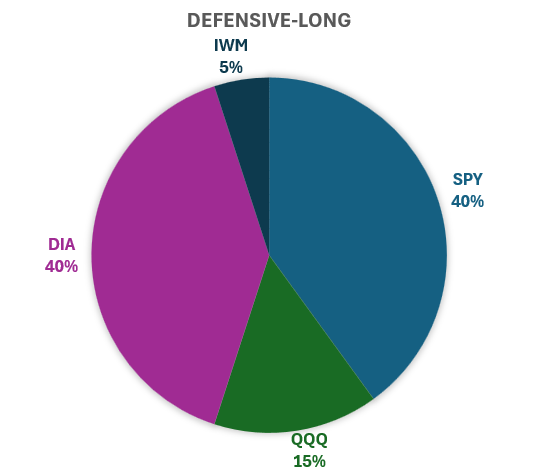

The reason for the shift was straightforward. After a strong advance earlier in the month, the internal structure of the market began to deteriorate. The wave had rolled over from its peak and was entering a trough phase. By mid-week on January 28, conditions had weakened enough that the framework called for a move into a more conservative configuration: 40% SPY, 40% DIA, 15% QQQ, and 5% IWM.

Importantly, this was not a call to abandon the market. The goal was to recognize that the balance between risk and reward had shifted—downside risk had become more significant than the remaining upside potential. The Defensive allocation is tilted toward large-cap, stable indexes while reducing exposure to higher-beta segments that tend to sell off more sharply during weakness. It keeps you fully invested, just positioned differently.

For now, the wave remains in a trough-building phase, despite the impressive rally on Friday. The portfolio will stay in its Defensive configuration until the underlying structure improves and both breadth and momentum turn back up in a synchronized way. When that happens, the framework will shift back toward a more aggressive stance. Until then, the focus is on continuing to participate in the market while cushioning the impact of this phase of the wave.

Since the beginning of December (when the Wave-State was publicly introduced), the Wave-State Model has delivered a +2.18% return, outpacing SPY's +0.98% by +1.19%. The past ten days validated the framework. The Defensive shift worked exactly as designed.

Author note: Market analysis and this blog post were conducted and written with the assistance of AI analysis under human oversight.

Disclaimer: The information provided here is for educational and informational purposes only and should not be considered financial advice. I am not a licensed financial advisor, and my portfolio may not be appropriate for your financial goals or risk tolerance. All investments involve risk, including the potential loss of principal. Historical data and market models are not indicative of future results. Please consult with a licensed financial professional before making any investment decisions.