A New Equity Market Model (This Could Be Big.)

I’ve spent the last several years researching how markets actually move, not just price patterns, but breadth, momentum, volatility, and the internal health of the entire market ecosystem.

That research recently led to a powerful finding:

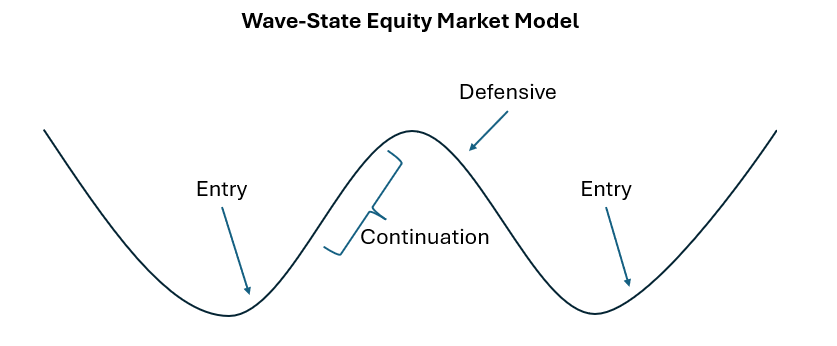

U.S. equity markets tend to move through three repeatable “Wave-States.”

From that discovery, I’ve built the Wave-State Equity Model, a rules-based approach that stays fully invested and adjusts index ETF exposure depending on the market’s current state:

Entry State: early improvement → opportunity phase

Continuation State: established strength → participation phase

Defensive State: weakening conditions → preservation phase

This isn’t market timing.

It’s adaptive exposure based on how markets have historically behaved in each state.

Backtesting has shown that this state-based approach, particularly when utilizing tactical leverage in Entry phases, has consistently outperformed the broader market across multiple cycles and protected against significant losses.

The mission is simple:

Beat the market by staying in the market while adjusting Index ETF portfolio exposure (SPY, DIA, QQQ, IWM) as the wave evolves, and apply tactical leverage during high probability wave-states.

Summary

Through independent research, I’ve identified what I now call the Wave-State Equity Model, a repeatable structure in how market trends evolve through phases of improvement, continuation, and deterioration.

Using this model, I backtested a rules-based allocation strategy, including tactical leverage during early-strength periods, and found consistent outperformance versus the broad market.

The approach remains always invested, rotating among index ETF allocations that correspond to the three Wave-States: Entry, Continuation, and Defensive.

The Wave-State Equity Model is not based on a single technical indicator, and it is not derived from studying one ETF in isolation.

This is not just a stochastic oscillator on a chart or a moving average crossover on a specific index.

The Evolution Into the Wave-State Equity Model

Over the past several years, our research into market behavior has led to a surprising but powerful independent finding: equity markets tend to move through a consistent three-phase structure, cycling between early improvement, sustained strength, and internal deterioration. This insight became the foundation of the Wave-State Equity Model, a structured approach for understanding where the market sits within its broader trend “wave.”

Unlike traditional timing systems, the Wave-State Model does not attempt to forecast tops or bottoms. Instead, it identifies the character of the environment and adjusts portfolio exposure accordingly. Our guiding philosophy is simple:

We aim to beat the market by staying in the market while adjusting ETF exposure, including high probabilty leverage periods, as the wave evolves.

A Broad-Market Approach, Not a Single-Indicator System

One essential distinction of the Wave-State Equity Model is that it is not based on a single technical indicator, and it is not derived from studying one ETF in isolation. This is not just a stochastic oscillator on a chart or a moving average crossover on a specific index.

Instead, the model reflects a holistic analysis of the equity market as a whole, incorporating:

Market breadth and the degree of participation across sectors

Momentum structure across major index families

Volatility conditions, particularly how implied volatility behaves in different phases

Cross-index relationships, including divergences between small caps, large caps, and tech leadership

Overall trend coherence, identifying whether the market is aligned or fractured

By evaluating how the entire market ecosystem behaves, not just one signal or one index, the Wave-State Model provides a broader and more stable interpretation of trend quality and trend deterioration.

This is a key reason the model works:

It defines states of the market, not merely signals on a chart. And those states have shown remarkably consistent historical behavior.

The Three States of the Wave

1. Bullish Entry State

(The beginning of a rising wave — highest opportunity)

The Entry State identifies the earliest stage of new upside momentum, strong enough to matter, and early enough to offer a significant opportunity. Historically, this phase shows the most attractive reward-to-risk characteristics, which is why tactical leverage is permitted here.

This is the “opportunity phase” of the trend, and separating it from later stages is one of the breakthroughs of the Wave-State Model.

2. Bullish Continuation State

(The body of the wave — steady participation)

As conditions strengthen and stabilize, the trend enters a more mature phase. Markets often continue higher, but the advantages of early entry have already passed.

The Continuation State keeps the portfolio fully invested, but without leverage, using a diversified blend of index ETFs designed to ride the trend without unnecessary risk amplification.

This distinction between Entry and Continuation is a major improvement over the old methodology, which treated all bullish environments as identical.

3. Defensive State

(The wave weakens — preservation phase)

The Defensive State activates when the underlying character of the market begins to deteriorate. This can happen even when prices appear stable. Historically, these conditions precede greater volatility and weaker forward returns.

In this phase, exposure shifts toward more balanced, broad-market ETFs. We remain invested, consistent with our core mission, but in a configuration aimed at capital preservation and drawdown reduction.

Why the Wave-State Equity Model Works

1. It separates opportunity from participation.

Early-stage trends behave differently from mature ones. Treating them as distinct states improves performance.

2. It adjusts exposure, not participation.

The portfolio is never “risk-off” in the traditional sense. Instead, it adapts allocation weights to match the environment.

3. It is grounded in broad-market behavior.

Breadth, momentum, volatility, and inter-index dynamics all contribute to defining the wave.

4. It supports our mission.

The objective is clear: beat the market by staying fully invested and by aligning exposure with the most favorable historical environments.

Backtesting has shown that this approach consistently outperformed passive benchmarks, not through forecasting, but through disciplined adherence to state-based allocations.

This Week’s Market State: Defensive

As of Friday’s close, the Wave-State Equity Model shifted into a Defensive State. While overall indices remain elevated, internal conditions have started to roll over, historically a signal to adopt a more conservative ETF mix.

This isn’t a prediction of decline. It is a rules-based, historically grounded allocation shift designed to preserve capital during the later stages of the wave.